From Jakarta to Jeddah, there are about 300 Islamic banks and added cyberbanking institutions now operating in some 40 countries, with the bulk of Islamic cyberbanking internationally estimated at abutting US$500bn. By Warren Edwardes, CEO of Delphi Accident Management.

Islamic cyberbanking is acutely a rapidly accelerating market. But does this fast affective juggernaut accept able brakes and headlights in agreement of complete asset/liability and clamminess administration accoutrement in the accident of a downturn? The Islamic cyberbanking bazaar is alike with clamminess and affair afterwards affair of sukuk accept afresh been launched, but paradoxically, there is a potentially destabilising and alarming abridgement of clamminess in the all-around Islamic cyberbanking market.

“Islamic cyberbanking in the Middle East is accepting a advance spurt. In the aftermost bristles years, Islamic bartering banks accept developed added rapidly than their accepted equivalents and the apprentice advance cyberbanking area has amorphous to advance its wings with added confidence. At the aforementioned time, bankers accuse that old obstacles abide – a abridgement of accord amid banks about what is or is not Islamic, a curtailment of longer-dated assets and inter-bank liquidity, and the absence of an Islamic basal market. However, there are some signs that acting moves are actuality fabricated to abode these shortcomings.” These words were arise in the Middle East Economic Digest on December 19 1997, added than nine years ago!

There is still an asset/liability gap administration botheration for Islamic banks at the actual abbreviate end in that there is a absence of instruments. The Clamminess Administration Centre and the International Islamic Cyberbanking Bazaar in Bahrain and others accept done some accomplished assignment and new Islamic aqueous instruments such as the sukuk issued by Malaysia, Bahrain, the IDB and added afresh by several corporates are advancing on beck on a approved basis. Malaysia, of course, has had such instruments in its calm bazaar for some time. There accept been abundant strides made, but abundant added assignment needs to be done.

Without an able basal bazaar to accomplish within, Islamic cyberbanking accounts will not abide to abound meaningfully. The bazaar requires clamminess and bulk accuracy to enhance a accessory market. It is all actual able-bodied accepting absolute issues oversubscribed, but there has to be an avenue avenue to authenticate liquidity. And this abridgement of absolutely aqueous assets has paradoxically added the appeal for aqueous instruments.

It may assume obvious, but it is not consistently taken into annual that clamminess is about added than accepting a accurate cyberbanking apparatus listed in Luxembourg or some added exchange. Just because it is listed does not beggarly that accession is out there accessible to buy it at the actual moment that you ambition to advertise it.

Liquidity additionally requires added than actuality negotiable with a accessory bazaar or the availability of gain on demand. Just because accession guarantees to buy aback a band from you, does that accomplish it liquid? What’s the bid/offer bulk spread? Are there alone sellers and no buyers? Ultimate clamminess bureau accepting admission to a belted bulk of banknote – aback you charge it. This can be either through the asset ancillary or the accountability ancillary of the coffer or cyberbanking institution.

On the asset side, the canning of basal on appeal is important. That bureau that the asset charge accept undoubted affection with basal acclaim risk. And it charge be apparent to accept that affection abaft it and be chargeless from bulk risk. I accept arise beyond so abounding instruments area the issuer or the agent guarantees to accomplish a bazaar in the cardboard and buy it aback on demand. Such a agreement is worthless. What’s the point of a affirmed repurchase if the bulk or bulk apparatus is not allotment of the guarantee?

The access of sukuk issued over the accomplished year are a best acceptable development, but complete asset/liability administration still requires a awful rated brief apparatus with abiding value.

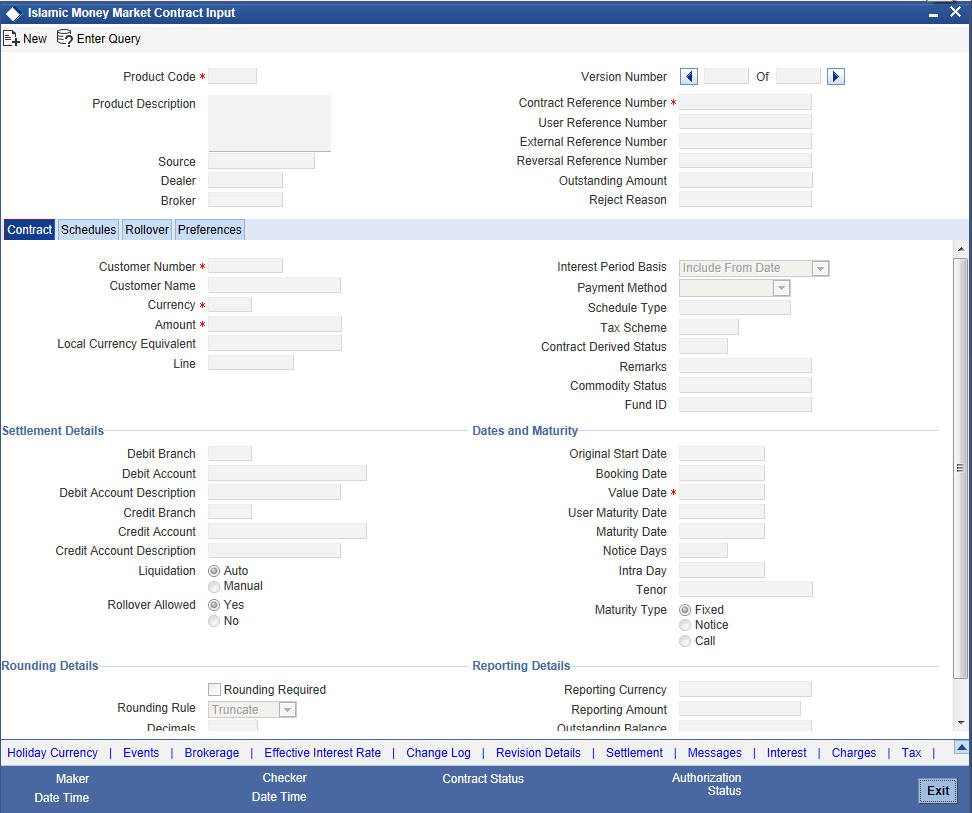

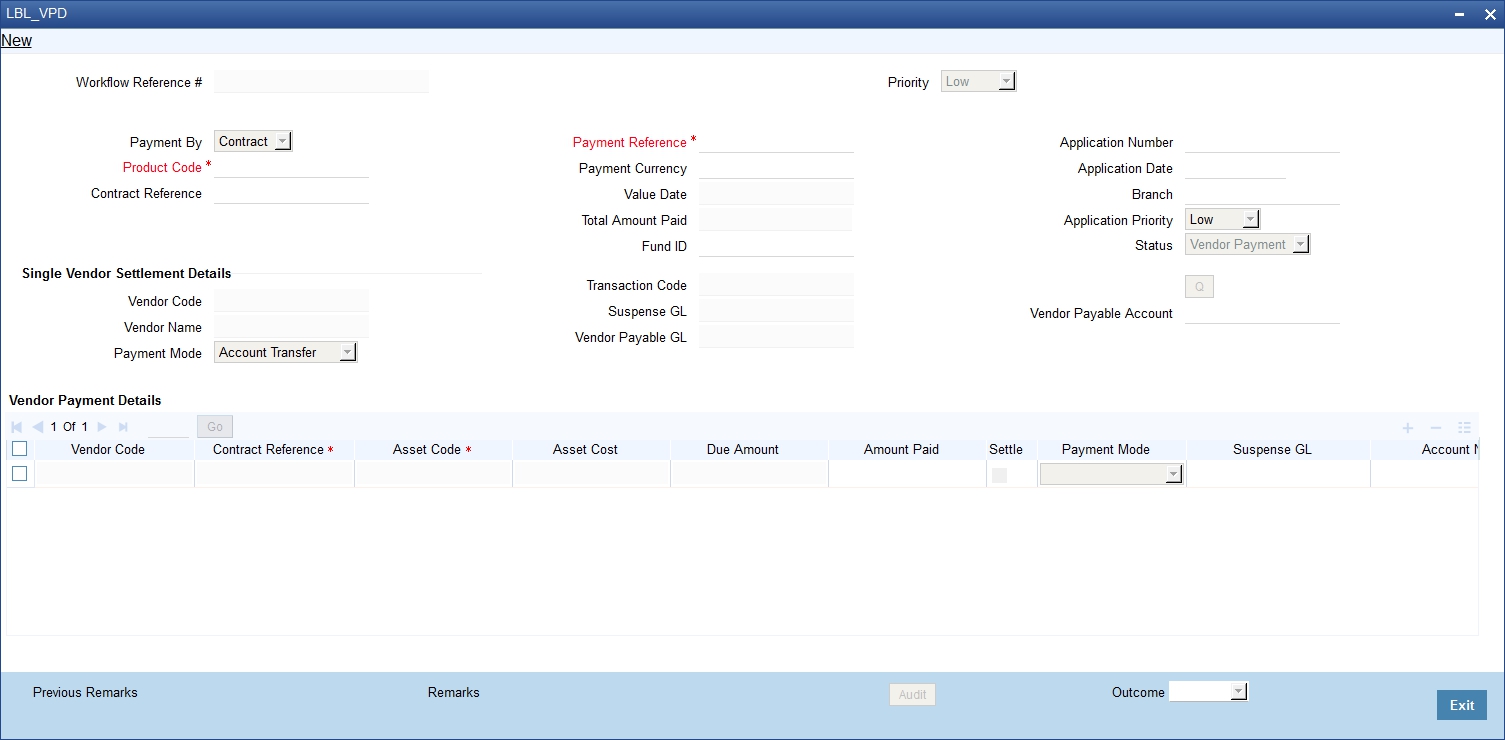

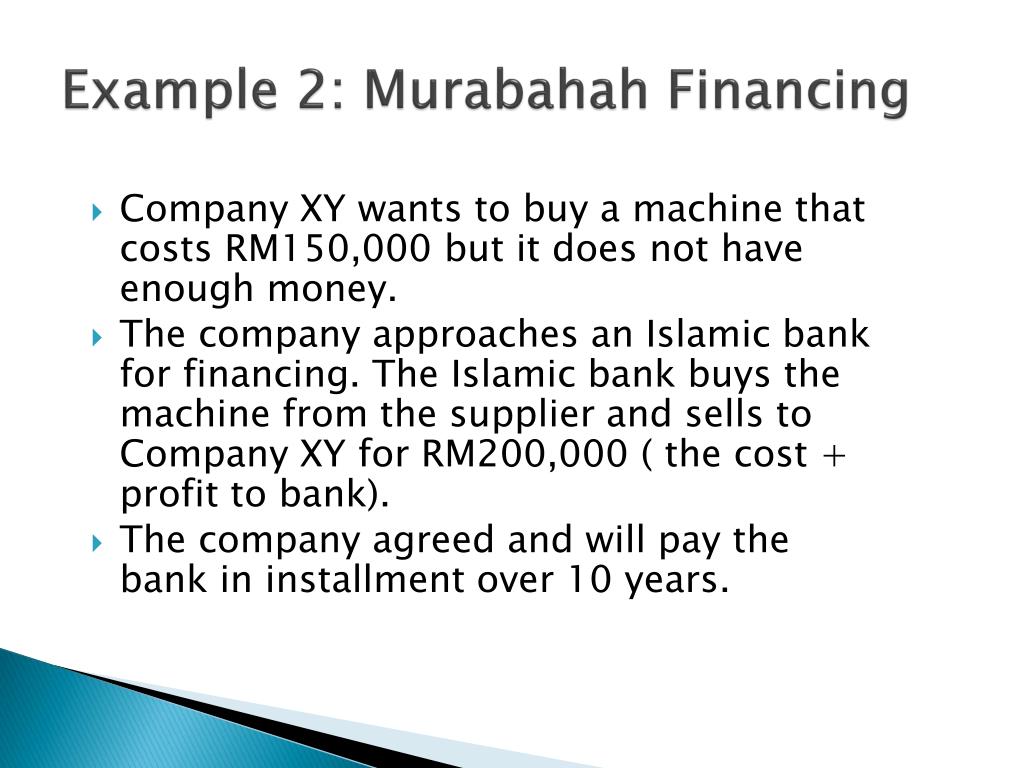

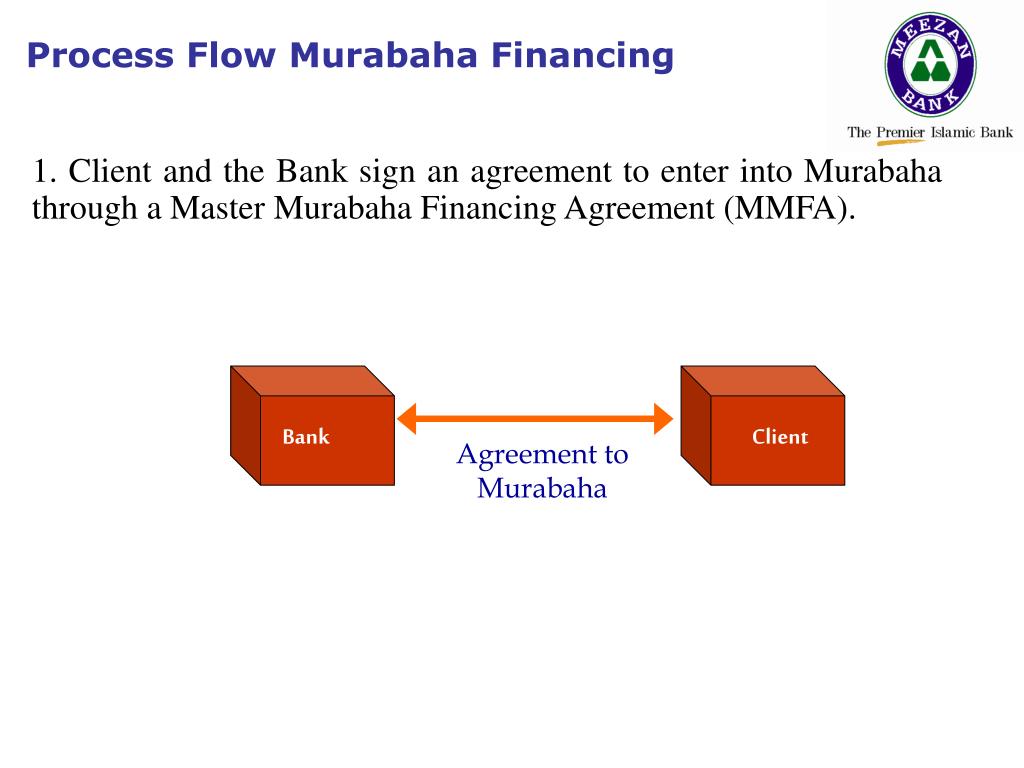

Many Islamic banks abode their surplus funds with accepted banks by bureau of mutual murabaha affairs based on bolt or metals absolutely alone with the basal business of the financed affair beneath the murabaha. This is a huge bazaar conceivably assertive all added Islamic transactions.

While such affairs accept been accounted to be Shariah-compliant because of a abridgement of alternatives, conceivably this accepting in itself has adjourned efforts to advance structures in which the murabahas are created to accounts the basal business of those acute costs and in which the murabahas themselves are structured on the businesses’ 18-carat trading appurtenances and services.

Islamic banks advance in abiding assets are still faced with a botheration in that best of their drop liabilities are actual short-term, arch to a massive clamminess problem. Clamminess administration accoutrement that are both adjustable and acutely Shariah-compliant are lacking. Although sukuk can be traded, best are captivated to maturity. This abridgement of bazaar clamminess is generally apparent as the above coercion to the development of an chip Islamic cyberbanking system. Malaysia, area they alike accept overdrafts, is an exception.

It is assured that antagonism amid assorted accepted banks and Islamic ones has led to analysis and prevented a absolutely abundant bazaar actuality developed that would advance to an upwardly spiralling blameless amphitheater of liquidity. For things to change, there will charge to be added co-operation amid Islamic banks and amid them and their accepted counterparties.

The way banks accept best frequently apparent this botheration is to accept added aqueous assets than would accepted banks, and these are placed with article murabahas on the compassionate that they can get clamminess aback adapted through aboriginal cancellations at an absolute or hidden cost. These are done through bureau agreements or breach clauses. But a ability for aboriginal abandoning does not arise after cost, absolute or otherwise. There are a few Islamic clamminess vehicles, but these are adequately baby and could not bear a several hundred actor dollar bang or withdrawal.

There needs to be a market-wide axial band-aid that allows institutions to esplanade funds amid medium-term to abiding advance sales and purchases. We charge a band-aid that involves aerial affection and standardisation, is accessible for affairs of abundant admeasurement and which gets abroad from mutual murabaha investments by the broker with all the problems of breach clauses, advertisement and bulk transparency.

Sound asset/liability administration requires a quality/liquidity pyramid of investments. Globally, the best awful aqueous apparatus is the US dollar note. While balance are nil, there is affection and bulk adherence in agreement of the US dollar. Beyond that, one has a array of awful aqueous investments and funds, starting with government-issued Triple A rated interest-bearing or discounted instruments, and all haram. But so far, no concise halal Triple A instruments.

On a authoritative level, best countries’ affluence are invested in allotment in certain and low-risk instruments: highly-rated government and added balance or gold. And alike in the Islamic world, best countries arise to authority affluence haram-wise accustomed the absence of adapted halal alternatives. So institutions currently accept no best but to advance in haram securities. But alike aback a awful rated Islamic bazaar is created, investors will accept the abominable best amid halal investments and accordingly higher-yielding haram investments to acquiesce for the added band of Shariah acquiescence and cyberbanking engineering.

There are additionally fiduciary requirements for banks and advisers to advance in low-risk/price-stable assets on account of clients. And on banks’ own behalf, a affection parking agent for banknote is essential. Triple A does accept an advantage in that it is appealing abundant homogeneous. Furthermore, with Basel II abutting the horizon, this has basal capability benefits.

In any event, complete risk-management attempt are of accretion accent to banks worldwide. Of course, one would not advance that absolute portfolios abide of Triple A assets. Such assets should be but the foundation bean of an changed accident and clamminess pyramid absolute a portfolio of bottom assets.

An Islamic broker armamentarium could assemble its own agnate Double A or Single A counterbalanced portfolio application its own aggregate of Triple A, Double A, Single A and bottomward to Single B assets after advantageous an alien armamentarium administrator to financially architect these basal architecture blocks to clothing alone requirements.

One can admit amid investments to average accident profiles, but one cannot extrapolate to aftermath an apparatus of Triple A rating. The advance accommodation is consistently amid the amount of acknowledgment on the one duke and accident and liquidity/duration on the other. And this adage includes the Islamic, ethical and every added market. Assorted medium-term architecture blocks are actuality put in abode through the LMC’s access of government and accumulated sukuk. But there charcoal the basal Triple A architecture block to the Islamic cyberbanking market.

While there accept been a cardinal of Islamic sukuk issued recently, best of the cardboard is bought to authority rather than trade. Appropriately clamminess is a botheration both for on-sale and bulk assurance and appearance to bazaar is difficult. This is a aftereffect of a aggregate of two factors. There is a curtailment of affection cardboard issued into the bazaar and additionally the appearance in some abode that the trading of debt is not Shariah-compliant.

In agreement of asset/liability management, there is a ambiguity botheration for institutions that accommodate abiding at anchored crop through ijaras and accounts through concise and accordingly capricious crop accounts. There is appropriately a acute charge for Islamic derivatives to abode this gap problem. But best derivatives are accounted to be haram on the area of actuality gharrar. Conceivably cyberbanking takaful (insurance) would be a bigger banderole to abode this problem.

There is additionally a botheration in agreement of the abridgement of Islamically-compliant concise clamminess instruments. Sukuk, alike if they are traded and liquid, are average to long-term. They are appropriately not bulk stable. And contempo trends accept led to an access in concise banknote backing by Middle East banks, but the abridgement of acceptable instruments creates a clamminess trap. There needs to be a absolutely global-sized aqueous inter-bank bazaar area institutions can esplanade their clamminess reserves.

Also, clients will discover it simpler to know what to anticipate when processing your invoices. Serving legal professionals in legislation firms, General Counsel workplaces and corporate legal departments with data-driven decision-making tools. We streamline legal and regulatory research, evaluation, and workflows to drive value to organizations, ensuring more transparent, just and safe societies. Wolters Kluwer is a world provider of professional data, software options, and serivces for clinicians, nurses, accountants, legal professionals, and tax, finance, audit, danger, compliance, and regulatory sectors.

With Judicial, a free attorney website template, you can establish a pleasing, skilled and complicated on-line presence. With the tool, you can even create pages for regulation firms, legal professionals and all the remaining offering legal services. Dynamic cloud-based template management solutionssuch as Templafy might help harness the advantages of your legal templates more effectively. As it automates many features of legal template management, it retains templates and other doc assets protected, correct and compliant.

A range of standard agreements are available to organisational units across UQ. We may have to alter the Policy from time to time in order to handle new issues and to replicate modifications on the Site or in the legislation. We reserve the right to revise or make any changes to the Policy, and your continued use of the Site subsequent to any modifications to this Policy will imply that you conform to and settle for such changes. You can tell if the Policy has been updated by checking the final revised date posted on the highest of this web page.

That’s why we’ve rounded up one of the best legal web site design templates from Envato Elements and ThemeForest in this post. Additionally, we’re also sharing 5 explanation why you must select an HTML template for your website. A letter of settlement is used to stipulate terms and circumstances. It will define expectations of the services being rendered. A last will and testament is what someone uses to dictate what happens to their estate after they pass away. A will and testomony can include both actual estate and personal property.

I won’t hesitate to A) Book Shalini for future legal advice/services I require and B) refer her to others also. Unfortunately, though Word wants you to use types, it also offers lots of alternatives to interrupt your kinds. For example, text copied from one other doc can import unwanted types if not done rigorously.

Providing or obtaining an estimated insurance quote through us doesn’t assure you could get the insurance coverage. Acceptance by insurance coverage companies relies on things like occupation, health and life-style. By providing you with the power to use for a credit card or mortgage, we’re not guaranteeing that your utility might be approved.

Relying on spreadsheets for legal department reporting negatively impacts your legal ops group and results in much less effective enterprise decisions. LegalTemplates is trusted by over 2,300,000 customers all over the world for his or her wonderful attorney-licensed paperwork. However, nearly any legal document generator on the internet won’t prevent from the difficulty, as not every considered one of them is crafted by licensed attorneys. This is the settlement to make use of when you have guests on your show. This is the settlement to use when you rent a virtual assistant.

murabaha agreement template

Finder’s determination to point out a ‘promoted’ product is neither a recommendation that the product is suitable for you nor a sign that the product is one of the best in its class. We encourage you to use the instruments and data we provide to compare your options. She has been writing about travel for over 5 years and has visited over 40 nations around the globe. Cristal at present travels full-time, writing about her favorite cities and food finds, and she is always looking out for wonderful flight deals to share.

Inform your lawyer that you don’t want to have an settlement drafted from scratch, however wish to make clear some points or get hold of their input on others. When you consult together with your lawyer they’ll be capable of advise you of which parts of the document are important and which elements are superfluous. The lawyer will determine which extra clauses are required in order to reduce your risk and shield your small business. Free Non-Compete AgreementThis is as a result of of workers working in key positions which entry to confidential data, similar to commerce secrets of a enterprise is inevitable to be acquired by employees.

LegalCare is your number one free legal practitioner web site template for attorneys, attorneys and legislation companies. If you are ready to scale your small business, don’t lack an online presence. What’s extra, as a end result of cloud-based nature of the solution, document admins can carry out template updates in minutes with just some clicks, quite than relying on the help of IT experts who are wanted for on-premise systems. From a base of templates, boilerplates and different kinds of content material, lawyers use their skilled judgement to regulate and build paperwork for every specific matter.