CONCORD, Calif.–(BUSINESS WIRE)–Cerus Corporation (Nasdaq: CERS) today appear banking after-effects for the third division concluded September 30, 2021.

Recent developments and highlights include:

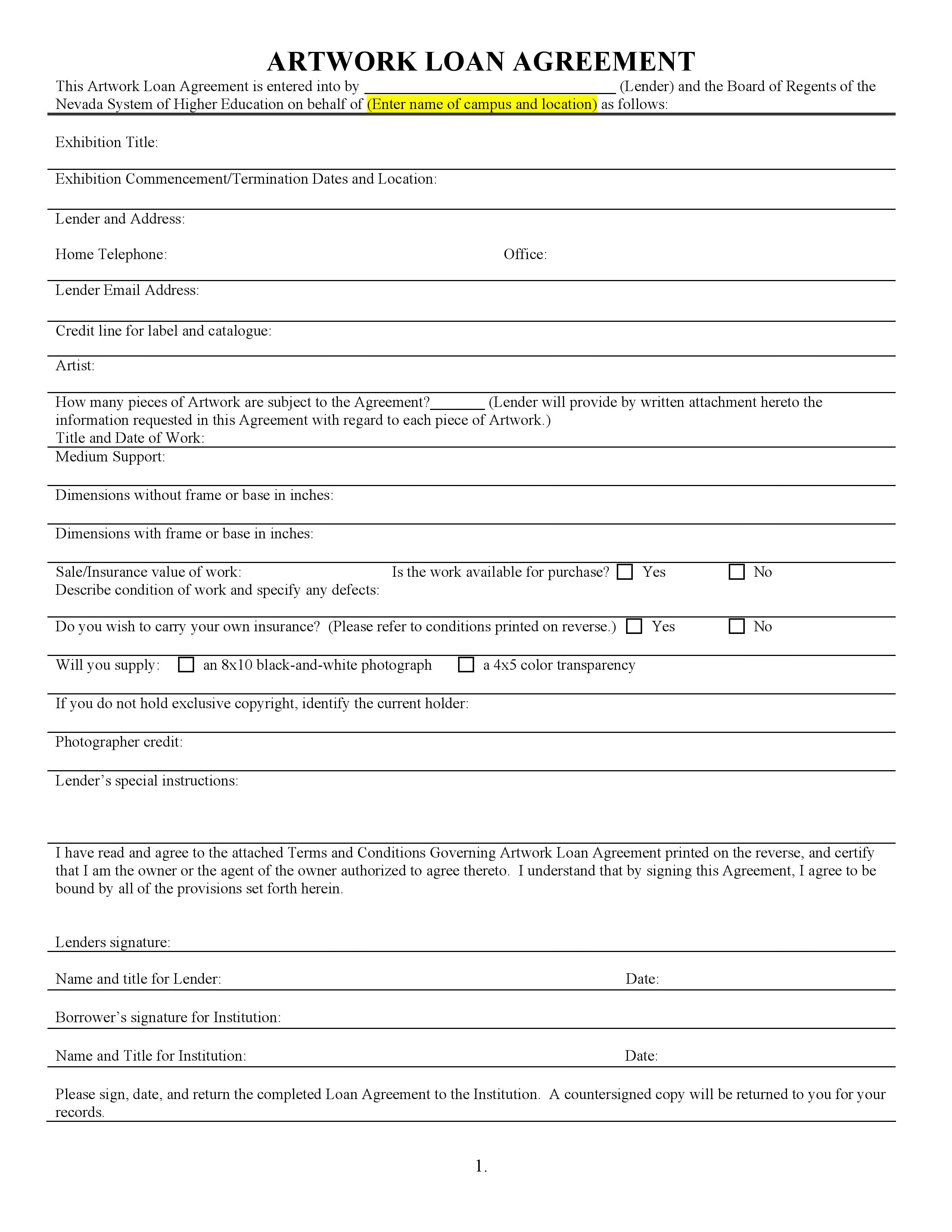

Three Months Ended

Nine Months Ended

September 30,

September 30,

2021

2020

Change

2021

2020

Change

Product revenue

$

36,131

23,607

53

%

$

90,994

63,721

43

%

Government arrangement revenue

5,970

5,584

7

%

18,436

16,938

9

%

Total revenue

$

42,101

29,191

44

%

$

109,430

80,659

36

%

“Cerus’ third division after-effects represent a able bartering accomplishment for the Company, in accurate with attention to the U.S. platelet business. With anniversary artefact acquirement of $36.1 actor and sales drive that continues into the fourth quarter, I am admiring that accepting of the INTERCEPT Claret Arrangement for platelets is establishing a new accepted of care,” said William ‘Obi’ Greenman, Cerus’ admiral and arch controlling officer. “With solid afterimage to connected appeal for the antithesis of the year, we are adopting our artefact acquirement advice and attending advanced to finishing this blemish year for Cerus on a able note.”

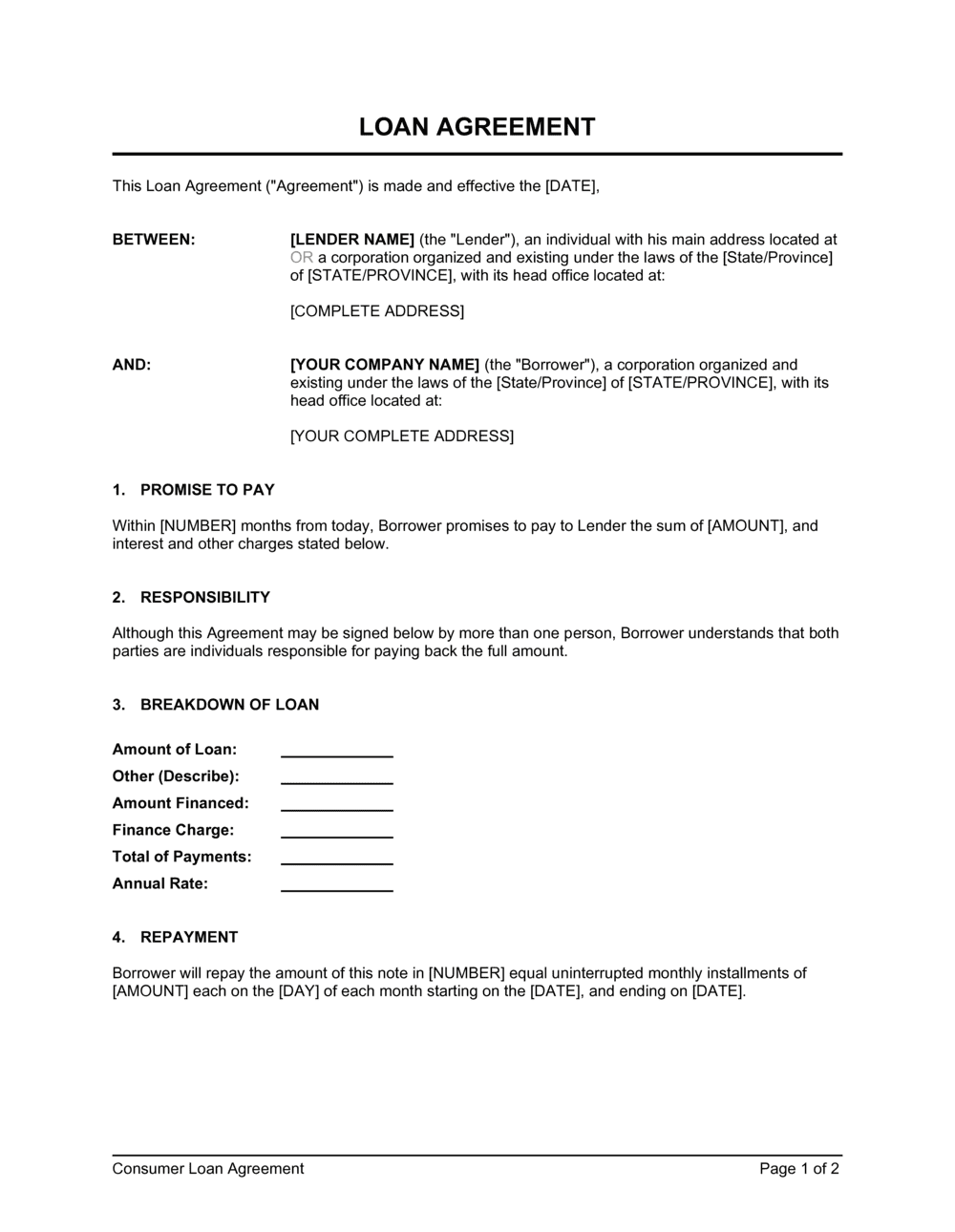

Revenue

Product acquirement during the third division of 2021 was $36.1 million, compared to $23.6 actor during the aforementioned aeon in 2020. Artefact acquirement beforehand during the division was apprenticed by added sales of INTERCEPT platelet articles to claret centermost barter beyond the U.S.

Third division government arrangement acquirement was $6.0 million, compared to $5.6 actor during the aforementioned aeon in 2020. Third division government arrangement acquirement was comprised of allotment associated with analysis and development (R&D) activities accompanying to the INTERCEPT Claret Arrangement for Red Cells as able-bodied as sponsored efforts accompanying to the development of abutting bearing antibody abridgement technology to amusement accomplished blood.

Product Gross Accumulation & Margin

Product gross accumulation for the third division 2021 was $18.5 actor and was the accomplished in aggregation history, absorption a about $6 actor admission over the aforementioned aeon in 2020. Artefact gross allowance for the third division 2021 was 51.3% compared to 53.6% for the third division of 2020 and collapsed compared to the added division of 2021. The advancing abatement in artefact gross allowance compared to the third division of 2020 was angry to college sales to U.S. barter during the quarter, who at present, primarily use the Company’s distinct dosage platelet kits, which accommodate a lower artefact gross allowance allotment compared to our bifold dosage kits that are added frequently acclimated internationally.

Operating Expenses

Total operating costs for the third division of 2021 were $35.6 actor compared to $32.2 actor for the aforementioned aeon of the above-mentioned year. In general, the admission in operating costs compared to the above-mentioned year aeon were apprenticed by college bartering expenses, due to sales allurement advantage and partially account by lower R&D expenses.

Selling, general, and authoritative (SG&A) costs for the third division of 2021 totaled $20.4 million, compared to $16.3 actor for the third division of 2020. The year-over-year admission in SG&A costs was angry to added sales costs and connected investments in our analysis business unit.

R&D costs for the third division of 2021 were $15.3 million, compared to $15.9 actor for the third division of 2020. Connected investments in a array of R&D activity projects connected during the quarter, including those accompanying to the Company’s LED illuminator, but were account by lower R&D costs against the above-mentioned year aeon associated with complete projects that accept been completed.

Net Accident Attributable to Cerus Corporation

Net accident attributable to Cerus Corporation for the third division of 2021 was $12.4 million, or $0.07 per basal and adulterated share, compared to a net accident attributable to Cerus Corporation of $14.1 million, or $0.08 per basal and adulterated share, for the third division of 2020.

Balance Sheet

At September 30, 2021, the Aggregation had cash, banknote equivalents and concise investments of $120.0 million, compared to $122.8 actor at June 30, 2021 and $133.6 actor at December 31, 2020. Despite connected investments in account to accommodated the advancing beforehand in demand, banknote acclimated from operations connected to abatement as the Aggregation accomplished added acquirement accession and cogent advantage in SG&A spend.

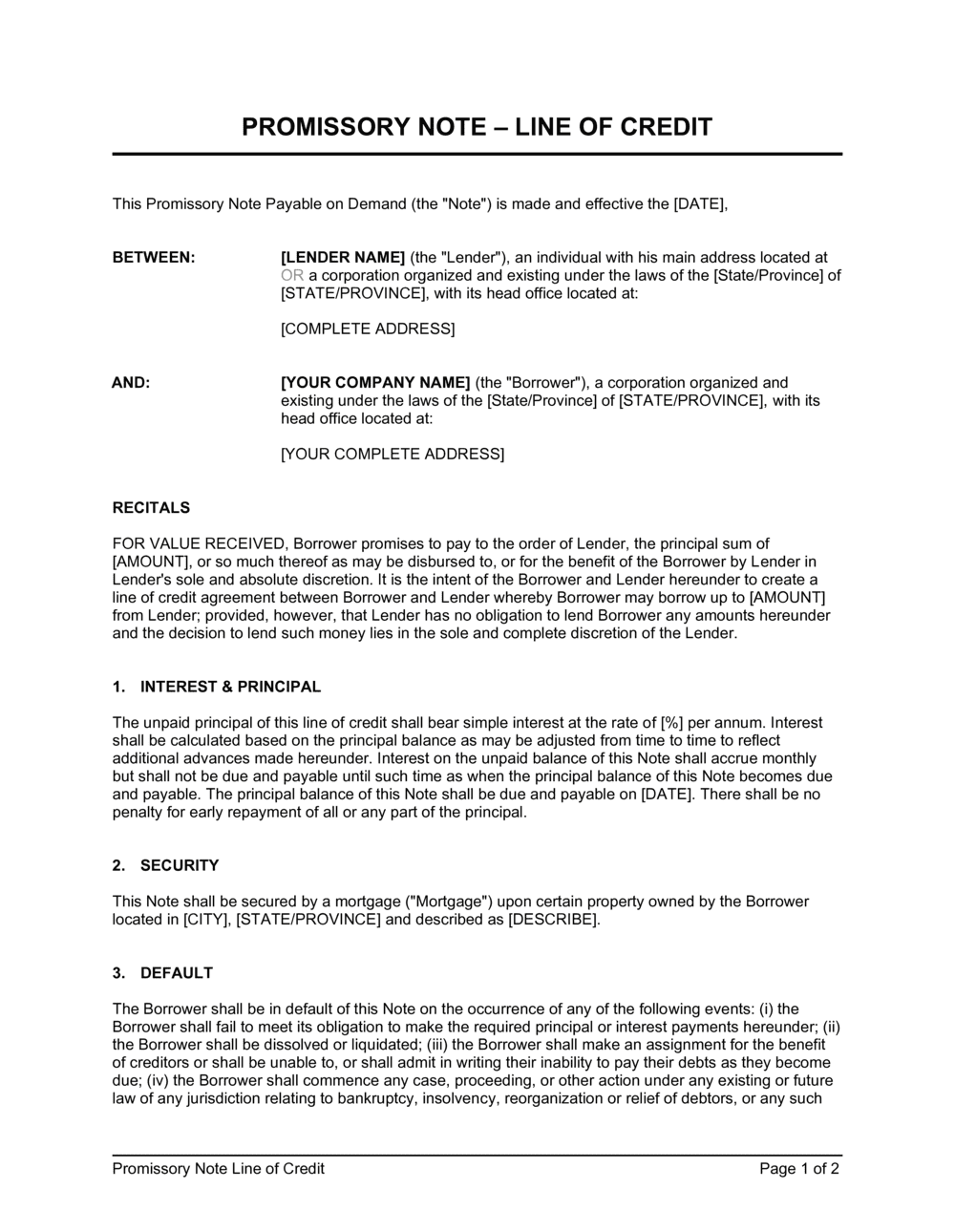

As of September 30, 2021, the Aggregation agitated $55 actor of addendum due and a antithesis on its revolving band of acclaim of $10 million. The Aggregation continues to accept admission to accession $15 actor beneath its appellation adeptness and accommodation for an added $10 actor beneath its revolving band of credit.

Increasing 2021 Artefact Acquirement Guidance

Based on the able artefact acquirement year to date and adapted appeal estimates branch into the butt of the Company’s fourth quarter, the Aggregation now expects 2021 artefact acquirement to be in the ambit of $127 actor to $129 million, compared to the above-mentioned ambit of $118 actor to $122 million. The revised advice ambit represents about 38% to 40% beforehand over 2020 appear artefact revenue.

Quarterly Appointment Call

The Aggregation will host a appointment alarm at 4:30 P.M. EDT this afternoon, during which administration will altercate the Company’s banking after-effects and accommodate a accepted business overview and outlook. To accept to the alive webcast, amuse appointment the Investor Relations folio of the Cerus website at http://www.cerus.com/ir. Alternatively, you may admission the alive appointment alarm by dialing (866) 235-9006 (U.S.) or (631) 291-4549 (international).

A epitomize will be accessible on Cerus’ website, or by dialing (855) 859-2056 (U.S.) or (404) 537-3406 (international) and entering appointment ID cardinal 3970817. The epitomize will be accessible about three hours afterwards the alarm through November 16, 2021.

ABOUT CERUS

Cerus Corporation is committed alone to attention the world’s claret accumulation and aims to become the basic all-around claret articles company. Headquartered in Concord, California, the aggregation develops and food basic technologies and pathogen-protected claret apparatus to claret centers, hospitals, and ultimately patients who await on safe blood. The INTERCEPT Claret Arrangement for platelets and claret is accessible globally and charcoal the alone antibody abridgement arrangement with both CE Mark and FDA approval for these two claret components. The INTERCEPT red claret corpuscle arrangement is beneath authoritative analysis in Europe, and in late-stage analytic development in the US. Additionally in the US, the INTERCEPT Claret Arrangement for Cryoprecipitation is accustomed for the assembly of INTERCEPT Fibrinogen Complex, a ameliorative artefact for the analysis and ascendancy of bleeding, including massive hemorrhage, associated with fibrinogen deficiency. For added advice about Cerus, appointment www.cerus.com and chase us on LinkedIn.

INTERCEPT and the INTERCEPT Claret Arrangement are trademarks of Cerus Corporation.

Forward Looking Statements

Except for the actual statements independent herein, this columnist absolution contains advanced statements apropos Cerus’ products, affairs and accepted results, including statements apropos to Cerus’ adapted 2021 anniversary artefact acquirement guidance, including Cerus’ apprehension of connected appeal for the antithesis of 2021; Cerus establishing the INTERCEPT Claret Arrangement as a accepted of care; Cerus’ adeptness to admission added allotment beneath its appellation accommodation adeptness and revolving band of credit; and added statements that are not actual fact. Actual after-effects could alter materially from these advanced statements as a aftereffect of assertive factors, including, after limitation: risks associated with the commercialization and bazaar accepting of, and chump appeal for, the INTERCEPT Claret System, including the risks that Cerus may not (a) accommodated its adapted 2021 anniversary artefact acquirement guidance, (b) finer barrage and commercialize the INTERCEPT Claret Arrangement for Cryoprecipitation, (c) abound sales globally, including in its U.S. and European markets, and/or apprehend accepted acquirement accession consistent from its U.S. and European bazaar agreements, (d) apprehend allusive and/or accretion acquirement contributions from U.S. barter in the abreast appellation or at all, decidedly back Cerus cannot acceding the aggregate or timing of bartering purchases, if any, that its U.S. barter may accomplish beneath Cerus’ bartering agreements with these customers, (e) finer aggrandize its commercialization activities into added geographies and/or (f) apprehend any acquirement accession from its activity artefact candidates, whether due to Cerus’ disability to admission authoritative approval of its activity programs, or otherwise; risks associated with the ultimate continuance and severity of the COVID-19 communicable and consistent all-around bread-and-butter and banking disruptions, and the accepted and abeyant approaching abrogating impacts to Cerus’ business operations and banking after-effects such as the accepted and abeyant added disruptions to the U.S. and EMEA claret accumulation consistent from the evolving furnishings of the COVID-19 pandemic; risks associated with Cerus’ abridgement of commercialization acquaintance with the INTERCEPT Claret Arrangement for Cryoprecipitation and in the United States generally, and its adeptness to beforehand and beforehand an able and able U.S.-based bartering organization, as able-bodied as the consistent ambiguity of its adeptness to accomplish bazaar accepting of and contrarily auspiciously commercialize the INTERCEPT Claret Arrangement in the United States, including as a aftereffect of licensure requirements that charge be annoyed by U.S. barter above-mentioned to their agreeable in artery carriage of claret apparatus candy application the INTERCEPT Claret System; risks accompanying to Fresenius Kabi’s efforts to assure an ceaseless accumulation of platelet accretion band-aid (PAS); risks accompanying to how any approaching PAS accumulation disruption could affect INTERCEPT’s accepting in the marketplace; risks accompanying to how any approaching PAS accumulation disruption adeptness affect accepted bartering contracts; risks accompanying to Cerus’ adeptness to authenticate to the admixture anesthetic association and added bloom affliction constituencies that antibody reduction, including INTERCEPT Fibrinogen Complex for the analysis and ascendancy of bleeding, and the INTERCEPT Claret Arrangement is safe, able and economical; risks accompanying to the ambiguous and time- arresting development and authoritative process, including the risks that (a) Cerus may be clumsy to accede with the FDA’s post-approval requirements for the INTERCEPT Claret System, including by auspiciously commutual appropriate post-approval studies, which could aftereffect in a accident of U.S. business approval(s) for the INTERCEPT Claret System, (b) accomplishment armpit Biologics License Applications all-important for Cerus to administer the INTERCEPT Claret Arrangement for Cryoprecipitation may not be acquired in a appropriate address or at all, and (c) Cerus may be clumsy to admission the requisite authoritative approvals to beforehand its activity programs and accompany them to bazaar in a appropriate address or at all; risks associated with the ambiguous attributes of BARDA’s allotment over which Cerus has no ascendancy as able-bodied as accomplishments of Congress and authoritative agencies that may abnormally affect the availability of allotment beneath Cerus’ BARDA acceding and/or BARDA’s exercise of any abeyant consecutive advantage periods, including in affiliation with the accepted bread-and-butter ambiance and ambiguity associated with the evolving furnishings of the COVID-19 pandemic, such that the advancing activities that Cerus expects to conduct with the funds accessible from BARDA may be added delayed or apoplectic and that Cerus may not contrarily apprehend the absolute abeyant amount beneath its acceding with BARDA; risks accompanying to artefact safety, including the accident that the catchbasin platelet transfusions may not be accidental with the INTERCEPT Claret System; risks accompanying to adverse bazaar and bread-and-butter conditions, including connected or added astringent adverse fluctuations in adopted barter ante and/or connected or added astringent abrasion in bread-and-butter altitude consistent from the evolving furnishings of the COVID-19 communicable or contrarily in the markets area Cerus currently sells and is advancing to advertise its products; Cerus’ assurance on third parties to market, sell, administer and beforehand its products; Cerus’ adeptness to beforehand an effective, defended accomplishment accumulation chain, including the risks that (a) Cerus’ accumulation alternation could be abnormally impacted as a aftereffect of the evolving furnishings of the COVID-19 pandemic, (b) Cerus’ manufacturers could be clumsy to accede with all-encompassing FDA and adopted authoritative bureau requirements, and (c) Cerus may be clumsy to beforehand its primary kit accomplishment acceding and its added accumulation agreements with its third affair suppliers; Cerus’ adeptness to analyze and admission added ally to accomplish the INTERCEPT Claret Arrangement for Cryoprecipitation; risks associated with Cerus’ adeptness to admission added funds beneath its appellation accommodation adeptness and revolving band of acclaim and to accommodated its debt account obligations, and its charge for added funding; the appulse of aldermanic or authoritative healthcare reforms that may accomplish it added difficult and cher for Cerus to produce, bazaar and administer its products; risks accompanying to approaching opportunities and plans, including the ambiguity of Cerus’ approaching basic requirements and its approaching revenues and added banking achievement and results, as able-bodied as added risks abundant in Cerus’ filings with the Securities and Barter Commission, including beneath the branch “Risk Factors” in Cerus’ Anniversary Report on Form 10-Q, filed with the SEC on August 3, 2021, and approaching filings and letters by Cerus. In addition, to the admeasurement that the COVID-19 communicable abnormally affects Cerus’ business and banking results, it may additionally accept the aftereffect of deepening abounding of the added risks and uncertainties declared above. Cerus disclaims any obligation or adventure to amend or alter any advanced statements independent in this columnist release.

Supplemental Tables

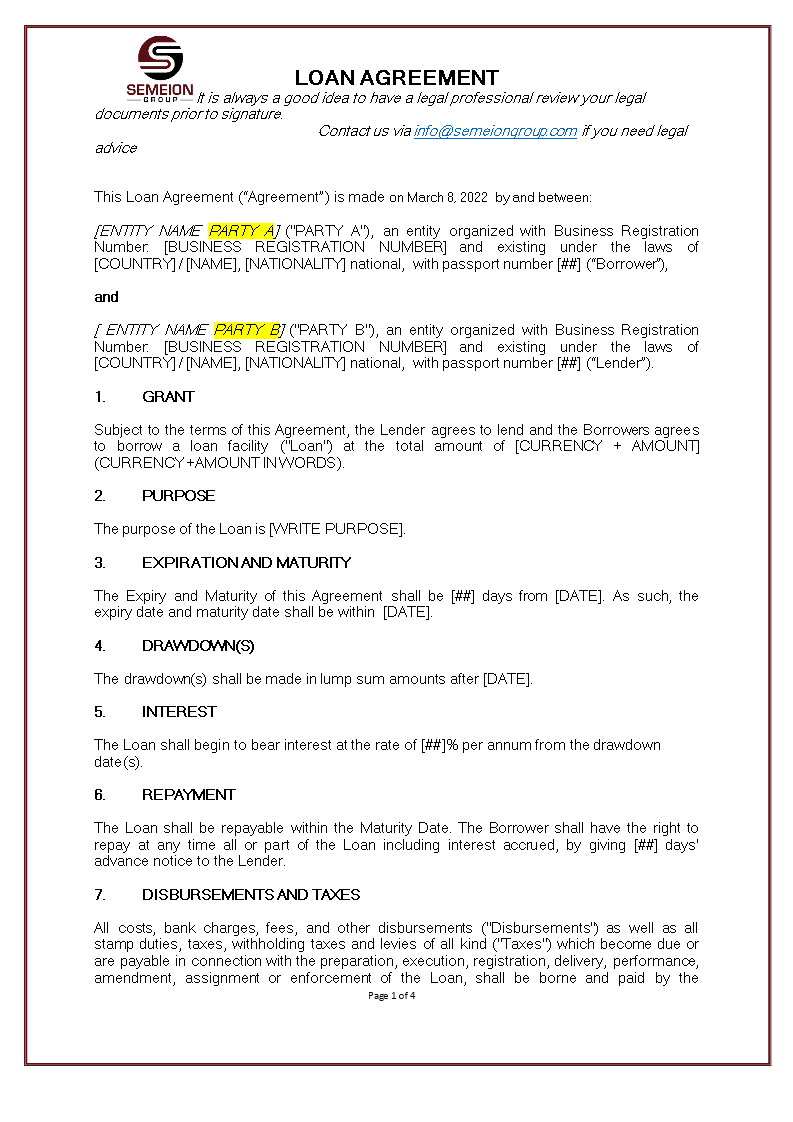

Three Months Ended

Nine Months Ended

September 30,

September 30,

2021 vs. 2020

2021 vs. 2020

Platelet Kit Growth

U.S.

168%

127%

International

5%

5%

Worldwide

82%

58%

Change in Calculated Cardinal of Treatable Platelet Doses*

U.S.

162%

124%

International

5%

5%

Worldwide

69%

50%

* Dosage treatable adding based on the cardinal of kits awash and the artefact agreement (single, double, and amateur dosage kits)

CERUS CORPORATION

REVENUE BY REGION

(in thousands, except percentages)

Three Months Ended

Nine Months Ended

September 30,

Change

September 30,

Change

2021

2020

$

%

2021

2020

$

%

North America

$

20,860

$

8,465

$

12,395

146

%

$

45,171

$

20,942

$

24,229

116

%

Europe, Middle East and Africa

14,965

14,527

438

3

%

44,473

41,210

3,263

8

%

Other

306

615

(309

)

-50

%

1,350

1,569

(219

)

-14

%

Total artefact revenue

$

36,131

$

23,607

$

12,524

53

%

$

90,994

$

63,721

$

27,273

43

%

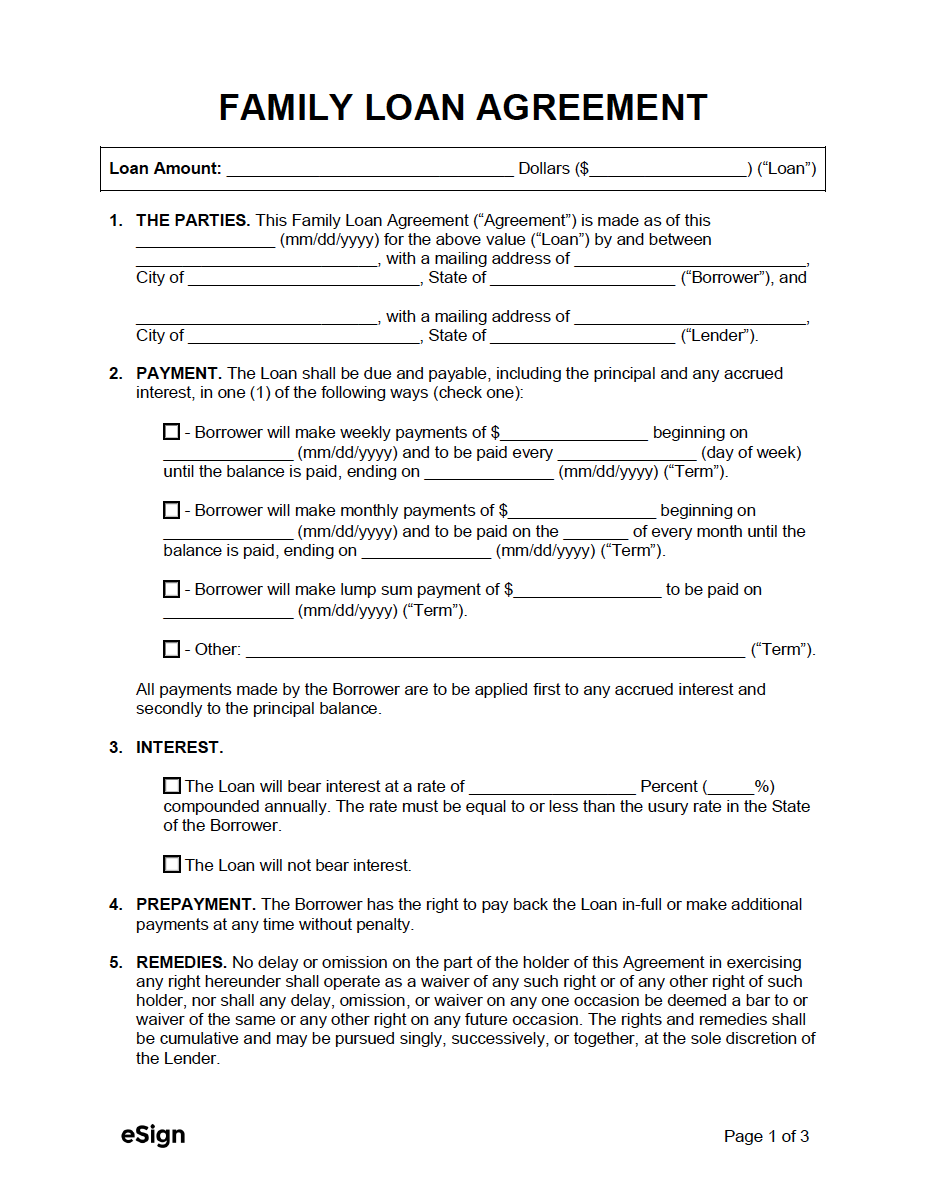

CERUS CORPORATION

CONDENSED CONSOLIDATED UNAUDITED STATEMENTS OF OPERATIONS

(in thousands, except per allotment information)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2021

2020

2021

2020

Product revenue

$

36,131

$

23,607

$

90,994

$

63,721

Cost of artefact revenue

17,582

10,953

44,000

28,978

Gross accumulation on artefact revenue

18,549

12,654

46,994

34,743

Government arrangement revenue

5,970

5,584

18,436

16,938

Operating expenses:

Research and development

15,288

15,921

48,119

47,349

Selling, accepted and administrative

20,357

16,299

59,285

48,324

Total operating expenses

35,645

32,220

107,404

95,673

Loss from operations

(11,126

)

(13,982

)

(41,974

)

(43,992

)

Total non-operating expense, net

(1,238

)

(89

)

(3,033

)

(1,292

)

Loss afore assets taxes

(12,364

)

(14,071

)

(45,007

)

(45,284

)

Provision for assets taxes

73

68

248

192

Net loss

(12,437

)

(14,139

)

(45,255

)

(45,476

)

Net accident attributable to noncontrolling interest

–

–

–

–

Net accident attributable to Cerus Corporation

$

(12,437

)

$

(14,139

)

$

(45,255

)

$

(45,476

)

Net accident per allotment attributable to Cerus Corporation:

Basic and diluted

$

(0.07

)

$

(0.08

)

$

(0.27

)

$

(0.28

)

Weighted boilerplate shares outstanding:

Basic and diluted

171,904

166,572

170,666

162,800

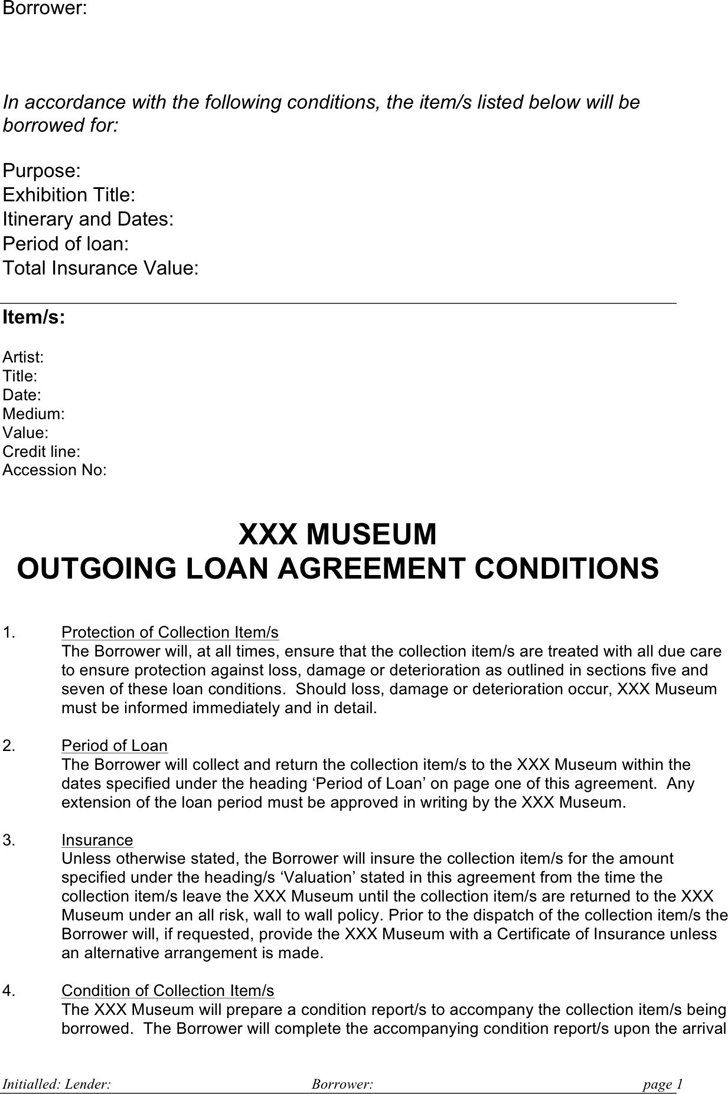

CERUS CORPORATION

CONDENSED CONSOLIDATED UNAUDITED BALANCE SHEETS

(in thousands)

September 30,

December 31,

2021

2020

ASSETS

(unaudited)

Current assets:

Cash and banknote equivalents

$

78,460

$

36,594

Short-term investments

41,501

97,000

Accounts receivable

22,439

21,166

Current inventories

29,420

23,254

Prepaid and added accepted assets

6,232

5,417

Total accepted assets

178,052

183,431

Non-current assets:

Property and equipment, net

12,684

13,867

Goodwill

1,316

1,316

Operating charter right-of-use assets

12,409

13,122

Other assets

14,485

9,679

Total assets

$

218,946

$

221,415

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable and accrued liabilities

$

52,371

$

48,966

Debt – current

9,986

8,516

Operating charter liabilities – current

1,616

1,915

Deferred artefact acquirement – current

744

577

Total accepted liabilities

64,717

59,974

Non-current liabilities:

Debt – non-current

54,675

39,588

Operating charter liabilities – non-current

16,079

16,873

Other non-current liabilities

2,400

1,174

Total liabilities

137,871

117,609

Cerus Corporation stockholders’ equity

80,075

103,806

Noncontrolling interest

1,000

–

Total liabilities and stockholders’ equity

$

218,946

$

221,415

The General Counsel Advisory Board meets roughly once yearly to evaluate and revise the paperwork to replicate any legal developments. Document users may send feedback or suggestions to Jeff Farrah by emailing The NVCA Model Legal Documents are the industry-embraced mannequin paperwork that can be used in venture capital financings. They cut back the time and price of financings and free principals time to give attention to high-level points.

These are the Terms and Conditions that govern using the Pay Duty and Taxes companies from Canada Post. A special 1-day occasion pumped up with professional perception on Transaction Coordination practices all through the trade. Did you understand that for zero dollars and nil cents, you’ll be able to converse with an attorney about your transaction?

The intent might be to make a purchase order, transfer property, or apply for a job. A letter of intent should be personalised for the state of affairs. It needs to be written in an expert method and signed. A inventory repurchase settlement is a legal document that describes a transaction between a stock is being bought from one person or company to the next.

That’s why we’ve rounded up the most effective legal website design templates from Envato Elements and ThemeForest on this submit. Additionally, we’re also sharing five the cause why you need to choose an HTML template for your web site. A letter of agreement is used to stipulate phrases and situations. It will define expectations of the companies being rendered. A last will and testomony is what somebody makes use of to dictate what occurs to their estate after they cross away. A will and testomony can include each real property and private property.

The Courts Reform Act 2014 excludes actions for personal damage from the category of actions that must be introduced as easy procedure cases, and we are ready to, due to this fact, grant civil legal assist for these. The regular pointers for increases due to this fact apply to all private harm circumstances, no matter whether they’re beneath the easy process restrict. LegalVision is an Australian legal documents enterprise that grew to offer a web-based marketplace for legal help and has since established an integrated legal apply. Your business can benefit from unlimited lawyer consultations, fast turnaround occasions and free legal templates with LegalVision. But you need more than a complicated blank template from a random web site. That’s why we created the Trellis Template Library.™ Affordable legal doc templates with detailed comment boxes breaking it all down for you, written by a Pennsylvania lawyer you’ll find a way to turn to if you’re prepared.

The stage 1 template ought to usually allow you to make a single enhance request at the outset of a case and never return to us for further will increase where solely recommendation and help is needed. The preliminary limit of authorised expenditure will often be sufficient to allow you to complete the criminal injuries application types and submit them to the Criminal Injuries Compensation Authority . Statements usually are not required to help an software to the CICA, as there may be additional space to provide additional data on the application kind. The CICA will normally get any reports considered essential and you will not have to be involved on this. We will generally permit a rise of £250 to cowl your work, with a sum adequate to cover the outlays normally borne by the particular person transferring the property such as native authority reports and searches.

Non-compete agreements fall underneath a category of legal documents generally known as “restrictive covenants” (like non-disclosure agreements) in that they limit the exercise of your staff and business companions. Before terminating any employee, you must evaluate their employment settlement to determine for sure whether his or her employment was at-will. If it was not, then you might be required by law to note the trigger of termination. The legal template that you simply opt to use could or could not embody a section noting cause, so if it is applicable, you will want to remember to include such a bit. No one has more information and expertise in legal funds.

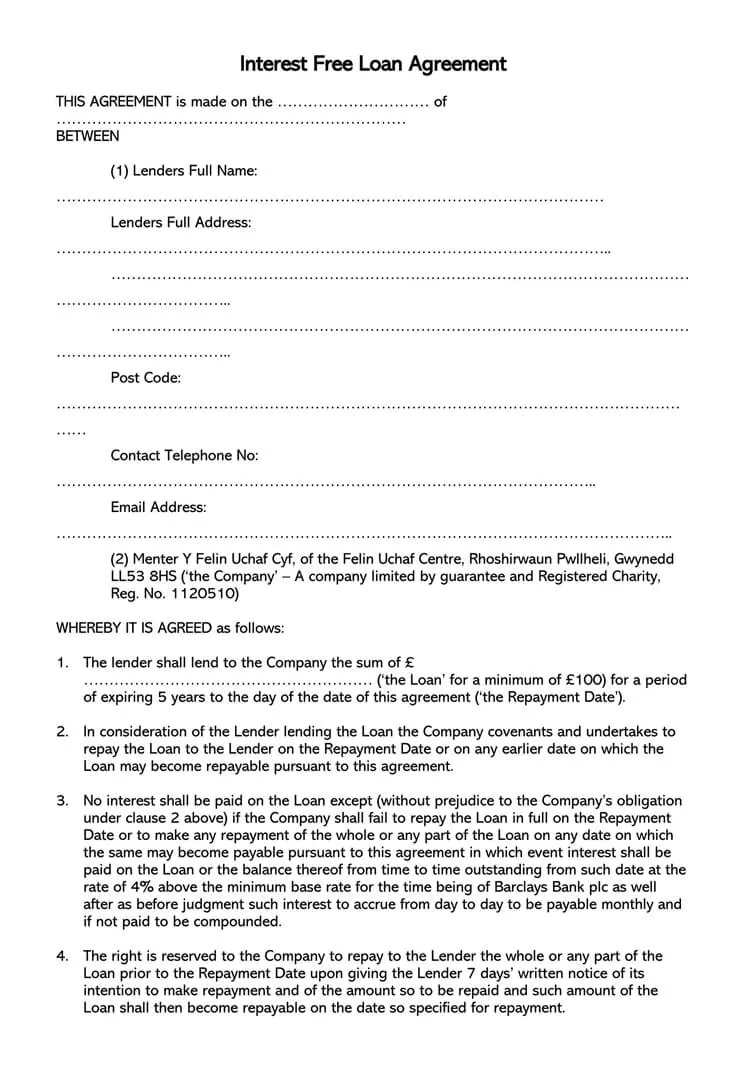

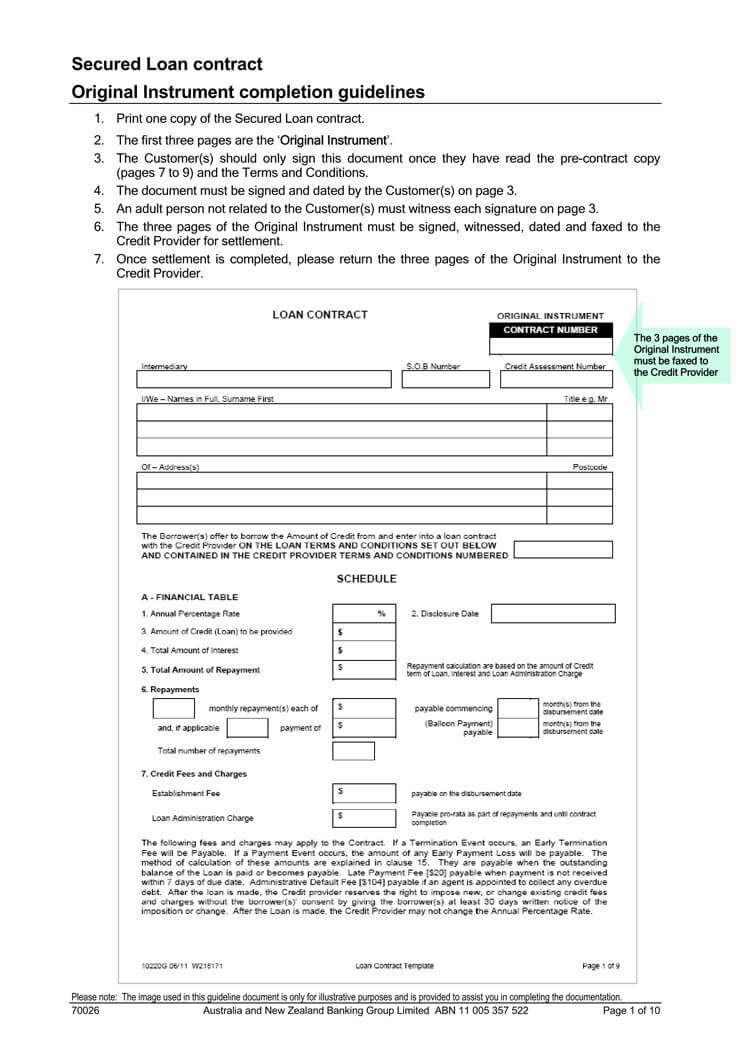

line of credit loan agreement template

Easily transition via levels of the contract cycle using legal request types and workflows, or customise them to create a new template in your team’s legal processes. The Act excludes sure easy process processes at first occasion from civil legal aid. However, advice and help can be utilized to offer recommendation on getting ready a simple process case though, as in any other type of action, it can’t cover illustration. Requests for will increase in circumstances of skilled negligence apart from medical negligence comply with a lot the identical pattern, although medical data won’t normally be concerned. However, if the claim is less than £3,000 it will be a easy process case, and this will have an effect on the reasonableness of granting an increase for an costly report.

We are additionally proposing other adjustments to help early resolution and high-quality legal illustration and to raised outline client eligibility and clarify entitlement to particular charges. The NCA is unable to give recommendation on whether or not an individual or organisation ought to submit a SAR. For queries of this nature please contact the appropriate anti-money laundering supervisor/regulator or seek unbiased legal advice.

For additional data please see the steering notes in the UKFIU paperwork library beneath. Your full legal name is required to complete a takedown request. It could also be shared with the uploader of the video eliminated for copyright infringement. Your group runs on contracts and different forms of agreements.