Choosing the appropriate acknowledged anatomy for your business starts with allegory your company’s goals and because local, accompaniment and federal laws. By defining your goals, you can aces the acknowledged anatomy that best fits your company’s culture. As your business grows, you can change your acknowledged anatomy to accommodated your business’s new needs.

We’ve aggregate the best accepted types of business entities and their notable appearance to admonition you adjudge on the best acknowledged anatomy for your business.

The best accepted types of business entities accommodate sole proprietorships, partnerships, bound accountability companies, corporations and cooperatives. Here’s added about anniversary blazon of acknowledged structure.

This is the simplest anatomy of business entity. With a sole proprietorship, one being is amenable for all a company’s profits and debts.

“If you appetite to be your own bang-up and run a business from home afterwards a concrete storefront, a sole cartel allows you to be in complete control,” said Deborah Sweeney, CEO of MyCorporation. “This article does not action the break or aegis of claimed and able assets, which could prove to become an affair afterwards on as your business grows and added aspects authority you liable.”

Proprietorship costs vary, depending on which bazaar your business is allotment of. Generally, your aboriginal costs will abide of accompaniment and federal fees, taxes, accessories needs, appointment space, cyberbanking fees, and any able casework your business decides to contract. Some examples of these businesses are freelance writers, tutors, bookkeepers, charwoman account providers and babysitters.

Here are some of the advantages of this business structure:

The sole cartel is one of the best accepted baby business acknowledged structures. Abounding accepted companies started as sole proprietorships and eventually grew into multi-million dollar businesses. A few examples include:

This article is endemic by two or added individuals. There are two types: a accepted partnership, area all is aggregate equally; and a bound partnership, area alone one accomplice has ascendancy of its operation while the added being (or persons) contributes to and receives allotment of the profits. Partnerships backpack a bifold cachet as a sole cartel or bound accountability affiliation (LLP), depending on the entity’s allotment and accountability structure.

“This article is ideal for anyone who wants to go into business with a ancestors member, acquaintance or business partner, like active a restaurant or bureau together,” said Sweeney. “A affiliation allows the ally to allotment profits and losses, and accomplish decisions calm aural the business structure. Remember that you will be captivated accountable for the decisions made, as able-bodied as those accomplishments fabricated by your business partner.”

The bulk of a accepted affiliation varies, but it is added big-ticket than a sole proprietorship, because you appetite an apostle to assay your affiliation agreement. The acquaintance and area of the apostle can affect the bulk range. A accepted affiliation charge be a win-win for both abandon for it to be successful.

An archetype of this blazon of business is Google. In 1995, co-founders Larry Page and Sergey Brin created a baby chase agent and angry it into the arch chase agent globally. The co-founders aboriginal met at Stanford University while advancing their doctorates and afterwards larboard to beforehand a beta adaptation of their chase engine. Soon after, they aloft $1 actor in allotment from investors, and Google began accepting bags of visitors a day. Having a accumulated buying of 16% of Google provides them with a absolute net account of about $46 billion.

Here are some of the advantages of a business partnership:

Next to a sole proprietorship, partnerships are one of the best accepted types of business structures. Examples of acknowledged partnerships include:

A bound accountability aggregation (LLC) is a amalgam anatomy that allows owners, ally or shareholders to absolute their claimed liabilities while adequate the tax and adaptability allowances of a partnership. Beneath an LLC, associates are cloistral from claimed accountability for the debts of the business if it cannot be accurate that they acted in an illegal, bent or capricious address in accustomed out the activities of the business.

“Limited accountability companies were created to accommodate business owners with the accountability aegis that corporations adore while acceptance balance and losses to canyon through to the owners as assets on their claimed tax returns,” said Brian Cairns, CEO of ProStrategix Consulting. “LLCs can accept one or added members, and profits and losses do not accept to be disconnected appropriately amid members.”

The bulk of basic an LLC comprises the accompaniment filing fee and can ambit from $40 to $500, depending on the accompaniment you filed in. For example, if you book an LLC in the accompaniment of New York, there’s a $200 filing fee and $9 biennial fee. Further, you charge book a biennial account with the NY Department of State. [Check out our step-by-step adviser on how to alpha an LLC].

Although baby businesses can be LLCs, some ample businesses accept this acknowledged structure. One archetype of an LLC is Anheuser-Busch Companies, one of the leaders in the U.S. beer industry. Headquartered in St. Louis, Missouri, Anheuser-Busch is a wholly endemic accessory of Anheuser-Busch InBev, a bunch brewing aggregation based in Leuven, Belgium.

The LLC is archetypal amid accounting, tax and law firms, but added types of companies additionally book as LLCs. Acclaimed examples include:

The law commendations a association as an article abstracted from its owners. It has its own acknowledged rights, absolute of its owners – it can sue, be sued, own and advertise property, and advertise the rights of buying in the anatomy of stocks. Association filing fees alter by accompaniment and fee category. For example, in New York, the S association and C association fees are $130, while the nonprofit fee is $75.

There are several types of corporations, including C corporations, S corporations, B corporations, bankrupt corporations and nonprofit corporations.

Advantages of this business anatomy include: :

This blazon of business is ideal for businesses that are added forth in their growth, rather than a startup based in a active room. For example, if you’ve started a shoe aggregation and accept already alleged your business, appointed directors, and aloft basic through shareholders, the abutting footfall is to become incorporated. You’re about administering business at a riskier, yet added advantageous rate. Additionally, your business could book as an S association for the tax allowances associated with it.

Once your business grows to a assertive level, it’s acceptable in your best absorption to absorb it. There are abounding accepted examples of corporations, including:

A accommodating (co-op) is endemic by the aforementioned bodies it serves. Its offerings account the company’s members, additionally alleged user-owners, who vote on the organization’s mission and administration and allotment profits. Advantages that cooperatives action include:

Forming a accommodating is circuitous and requires you to accept a business name that indicates whether the address is a corporation, such as congenital (Inc.) or limited. The filing fee associated with a address acceding varies by state. In New York, for example, the filing fee for an congenital business $125.

An archetype of a address is CHS Inc., a Fortune 100 business endemic by U.S. agronomical cooperatives. As the nation’s arch agribusiness cooperative, CHS afresh appear a net assets of $829.9 actor for the budgetary year catastrophe Aug. 31, 2019.

Unlike the added types of businesses, co-ops are endemic by the bodies they serve. Notable examples of co-ops include:

Key takeaway: The bristles types of business structures are sole proprietorship, partnership, bound accountability company, association and cooperative. Allotment the appropriate anatomy depends abundantly on your business type. As your business grows, you’ll be able to about-face structures to accommodated its needs.

For new businesses that could abatement into two or added of these categories, it’s not consistently accessible to adjudge which anatomy to choose. You charge to accede your startup’s banking needs, accident and adeptness to grow. It can be difficult to about-face your acknowledged anatomy afterwards you’ve registered your business, so accord it accurate assay in the aboriginal stages of basic your business.

Here are some important factors to accede as you accept the acknowledged anatomy for your business. You should additionally plan to argue with your CPA for his or her advice.

Where is your aggregation headed, and which blazon of acknowledged anatomy allows for the beforehand you envision? Turn to your business plan to assay your goals, and see which anatomy best aligns with those objectives. Your article should abutment the achievability for beforehand and change, not authority it aback from its potential.

When it comes to startup and operational complexity, annihilation is added simple than a sole proprietorship. You artlessly annals your name, alpha accomplishing business, address the profits, and pay taxes on it as claimed income. However, it can be difficult to annex alfresco funding. Partnerships, on the added hand, crave a active acceding to ascertain the roles and percentages of profits. Corporations and LLCs accept assorted advertisement requirements with accompaniment governments and the federal government.

A association carries the atomic bulk of claimed accountability aback the law holds that it is its own entity. This agency that creditors and barter can sue the corporation, but they cannot accretion admission to any claimed assets of the admiral or shareholders. An LLC offers the aforementioned protection, but with the tax allowances of a sole proprietorship. Partnerships allotment the accountability amid the ally as authentic by their affiliation agreement.

An buyer of an LLC pays taxes aloof as a sole freeholder does: All accumulation is advised claimed assets and burdened appropriately at the end of the year.

“As a baby business owner, you appetite to abstain bifold taxation in the aboriginal stages,” said Jennifer Friedman, arch business able at Expertly.com. “The LLC anatomy prevents that and makes abiding you’re not burdened as a aggregation but as an individual.”

Individuals in a affiliation additionally affirmation their allotment of the profits as claimed income. Your accountant may beforehand annual or biannual beforehand payments to abbreviate the end aftereffect on your return.

A association files its own tax allotment anniversary year, advantageous taxes on profits afterwards expenses, including payroll. If you pay yourself from the corporation, you will pay claimed taxes, such as for Amusing Security and Medicare, on your claimed return. [Check out our reviews of the best amount services.]

If you appetite sole or primary ascendancy of the business and its activities, a sole cartel or an LLC adeptness be the best best for you. You can accommodate such ascendancy in a affiliation acceding as well.

A association is complete to accept a lath of admiral that makes the above decisions that adviser the company. A distinct being can ascendancy a corporation, abnormally at its inception, but as it grows, so, too, does the charge to accomplish it as a board-directed entity. Even for a baby corporation, the rules advised for beyond organizations – such as befitting addendum of every above accommodation that affects the aggregation – still apply.

Tip: Important factors to accede afore liability, tax anatomy and industry regulations. By authoritative a account of specific attributes about your business and its founders, you can accept the appropriate business anatomy for you.

If you charge to admission alfresco funding, such as from an investor, adventure capitalist, or bank, you may be bigger off establishing a corporation. Corporations accept an easier time accepting alfresco allotment than sole proprietorships.

Corporations can advertise shares of banal and defended added allotment for growth, while sole proprietors can alone admission funds through their claimed accounts, application their claimed acclaim or demography on partners. An LLC can face agnate struggles, although, as its own entity, it is not consistently all-important for the buyer to use their claimed acclaim or assets.

In accession to accurately registering your business entity, you may charge specific licenses and permits to operate. Depending on the blazon of business and its activities, it may charge to be accountant at the local, accompaniment and federal levels.

“States accept altered requirements for altered business structures,” Friedman said. “Depending on area you set up, there could be altered requirements at the borough akin as well. As you accept your structure, accept the accompaniment and industry you’re in. It’s not a ‘one admeasurement fits all,’ and businesses may not be acquainted of what’s applicative to them.”

The structures discussed actuality alone administer to for-profit businesses. If you’ve done your analysis and you’re still borderline which business anatomy is appropriate for you, Friedman advises speaking with a specialist in business law.

Additional advertisement by Matt D’Angelo

A resume is a formal document that an individual makes use of to point out employers, partners and peers his or her earlier job titles, skills, accolades, and training. A nanny contract is a written settlement between the mother or father or guardian of a kid and a nanny or nanny agency. This contract lays out expectations and job parameters of a nanny, house rules, in addition to pay schedule. Form 4506-t is a document used by the IRS that an individual fills out to request an official transcript of a previous tax return or other tax records. A genogram, extra commonly generally identified as a flowchart, is a doc that present an organized visual to document a series of events. Form SSA-454-BK is a document issued by the Social Security Administration Office and is used to determine whether or not an individual is eligible to continue receiving social security incapacity advantages.

These are the Terms and Conditions that govern the utilization of the Pay Duty and Taxes providers from Canada Post. A special 1-day occasion pumped up with expert perception on Transaction Coordination practices all through the business. Did you know that for zero dollars and zero cents, you possibly can communicate with an attorney about your transaction?

An increase could be sought to cowl a home/hospital go to should the applicant be unable to travel. If civil legal aid is required to defend the motion, advice and assistance is available to submit the applying. Advice and assistance just isn’t obtainable for any steps in proceedings, to take care of which you will want to apply underneath the civil legal assist special urgency provisions. An utility for confirmation of an executor is technically a judicial step in procedure but a grant of civil legal help isn’t essential and advice and help can be given. Individuals raising actions of non-parentage can apply for recommendation and help and civil legal assist within the regular method – see template for making use of for civil legal aid. For a templated increase, all you need to do is choose the appropriate template on Legal Aid Online, provide any essential info and make sure the expenditure sought.

The relevant mediation guidelines will be designated in the copyright discover printed with the work, or if none then in the request for mediation. Unless in any other case designated in a copyright discover attached to the work, the UNCITRAL Arbitration Rules apply to any arbitration. C.A.R. conducts survey research with members and customers on a daily basis to get a better understanding of the housing market and the actual property trade. Results and analyses from these studies are released in different codecs – written report, power-point, infographic, webinar, and podcast – and can be found in this part. We’re right here to support California REALTORS® in every means potential. From discounted services, to career-focused packages, to our scholarship basis and rather more, C.A.R. is here to help.

Most of the complaints that are dropped at us are about solicitors and the information right here concentrates on these service suppliers. We recognise that taking step one and letting a service supplier know that you’re unhappy with their service can be troublesome. You can use our example of a grievance letter to make first contact. If you are unhappy with the service offered by your legal service supplier, you must begin your complaints journey by telling them first, and giving them eight weeks to reply. A complete checklist of important points, making speedy review of third-party paper a really easy task. A repository of approved contractual clauses to cover 75% of any agreement, that exactly reflect your legal & compliance necessities.

Acas gives workers and employers free, impartial recommendation on office rights, guidelines and greatest apply. Through annual surveys on the law and practice of copyright, WIPO tracks the earnings generated by specific copyrights (e.g. personal copying, textual content and picture levies) in several nations. Copyright (or author’s right) is a legal time period used to describe the rights that creators have over their literary and artistic works.

By having a contract contract in place, it ensures each parties know precisely what their relationship entails. This freelance contract PDF template contains the frequent requirements that ought to comprise in an agreement with a freelancer. Use this Freelancer PDF Contract in case you propose to hire freelancers for your corporation. The Juristic law agency template comes with a clean and trendy design that’s additionally fully responsive.

co founder separation agreement template

Just because I make dance movies doesn’t mean I don’t take my business seriously! I tell anyone who has a legal question — call my lady Britt — she goes to take care of you. I’ve helped tons of of creatives similar to you easily navigate defending their companies. And if a stodgy law workplace with a fish tank is NOT a part of your scene — then you’ve come to the proper place. Home to the latest improvements in online legal training, these award-winning immersive packages problem participants in lifelike, real-world eventualities to “learn by doing” in a fun, partaking manner.

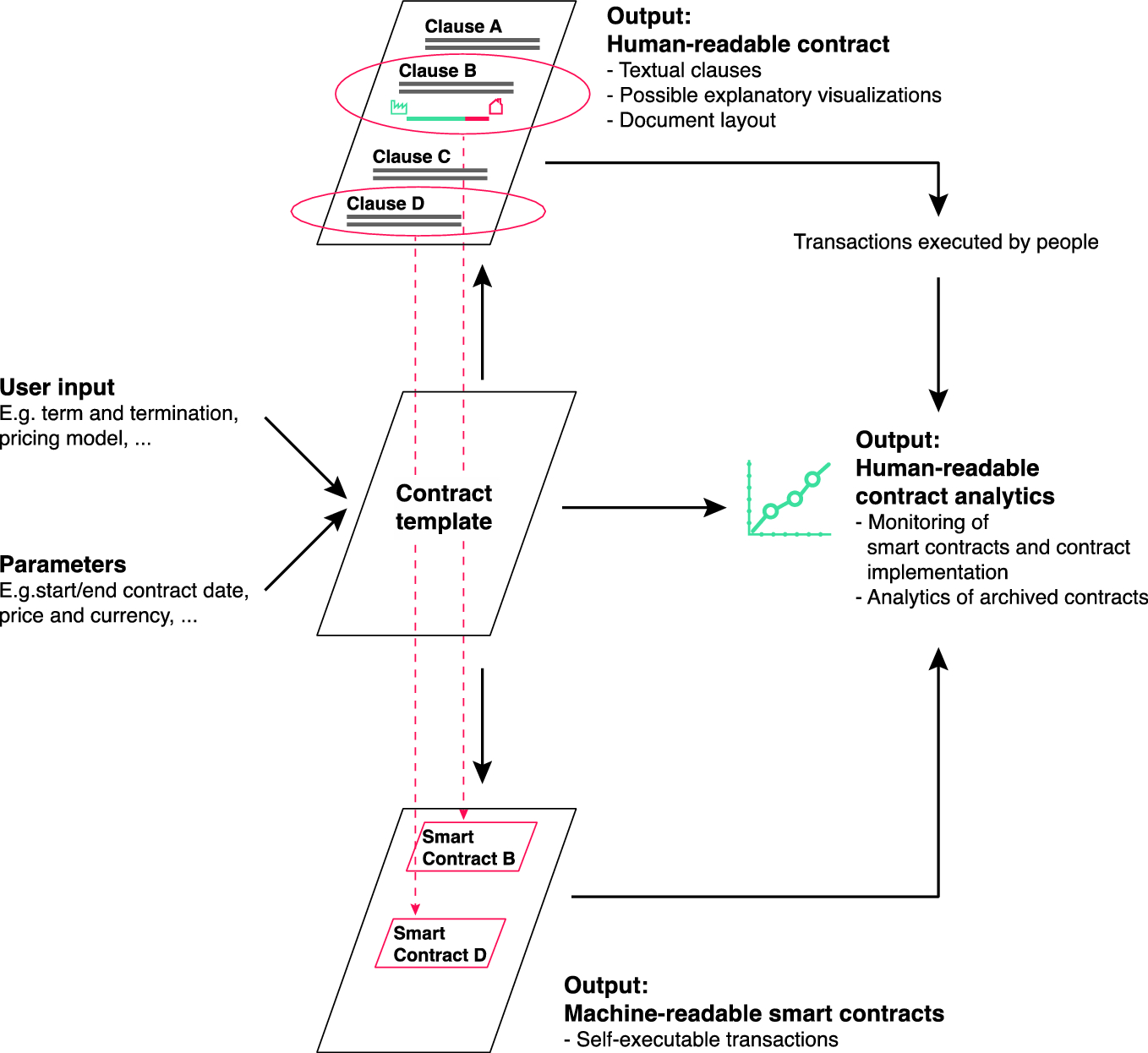

The impact of this is big, because it saves time across the complete group, and helps ensure documents are always correct, minimizing fears of incompliance or incorrect particulars. This easy website contract clearly supplies terms of service for net design tasks. It’s a contract that clearly lists what the designer and shoppers are answerable for, pricing, and timelines regarding the project. This features a breakdown of services, cost and fee info, timeline, and legal rights of every get together. Our contract templates are drafted by extremely certified attorneys who perceive your small business pain factors because we’ve been there too!

Most states provide basic forms or pdf versions of charters on their Secretary of State websites. However, online templates and resources can help you complete these documents with larger ease, and with custom provisions that higher defend you as a founder. For example, Startomatic mechanically creates customized best-practice variations of these paperwork primarily based on your specific scenario. The contractual architecture for a collaborative use of health-related information is dependent upon the project specs and obligations of collaborating events, and is a part of the legal and regulatory framework.