Debt Validation Letter Template. Look for a contract or promissory with your legitimate signature whereby you’re acknowledging responsibility for the debt. A debt validation letter ought to a minimum of ask for the information that collectors are legally obligated to reply. All future communications with me ought to be done in writing and despatched to the handle talked about in this letter. Occasionally, they might write back to you saying they’ve received your validation request, reviewed it, and given your account again to the vendor or up to date your credit score report back to remove the account.

If a debt collector, who isn’t the original creditor, contacts a client about an unpaid debt, the most suitable choice for the patron is to send a debt validation letter to the debt collector. You can simply download or print the Hawaii Letter to debt collector seeking verification of a debt in response to their validation letter from our companies. Pick a hassle-free doc format and download your duplicate.

DoNotPay follows you through the whole process, including reviewing your credit score report for errors and notifying creditors on your behalf. Customer Service Recommendation LetterRecommend your worker to a different company through the use of this Customer Service Recommendation Letter. Note –A verification or a validation process does not indicate the chance to skip or ignore paying the debt you owe. I signed up with United Debt Settlement because of large credit card debts, which had taken a financial toll on my credit score. Our companions can not pay us to ensure favorable reviews of their services or products.

Return receipts seem solely like a good way for USPS to make a couple of extra dollars. There is not any evidence they’re any extra valid in court than a monitoring quantity exhibiting the document has been delivered. Signature requests present a means for a recipient to impede delivery.

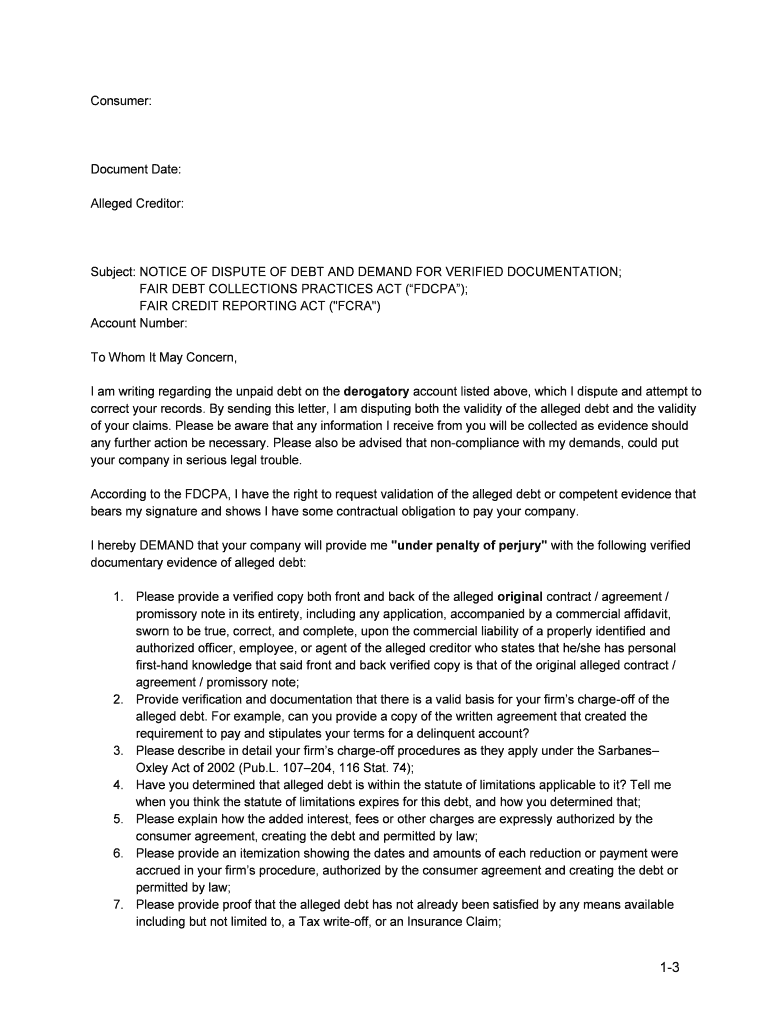

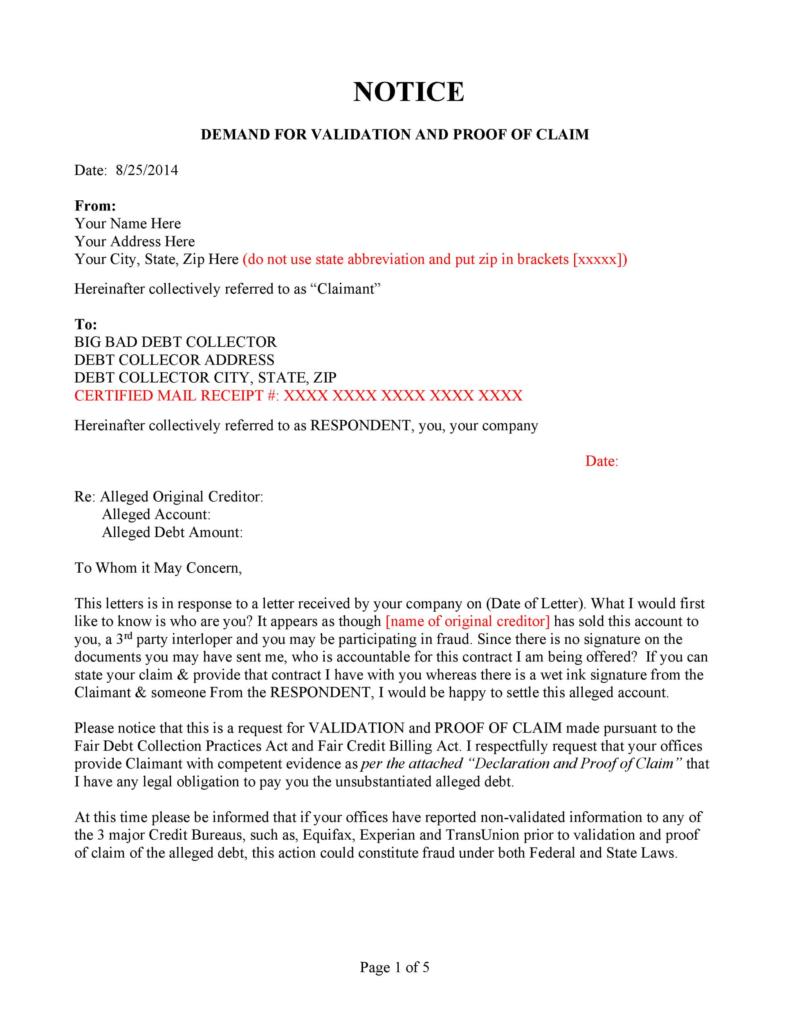

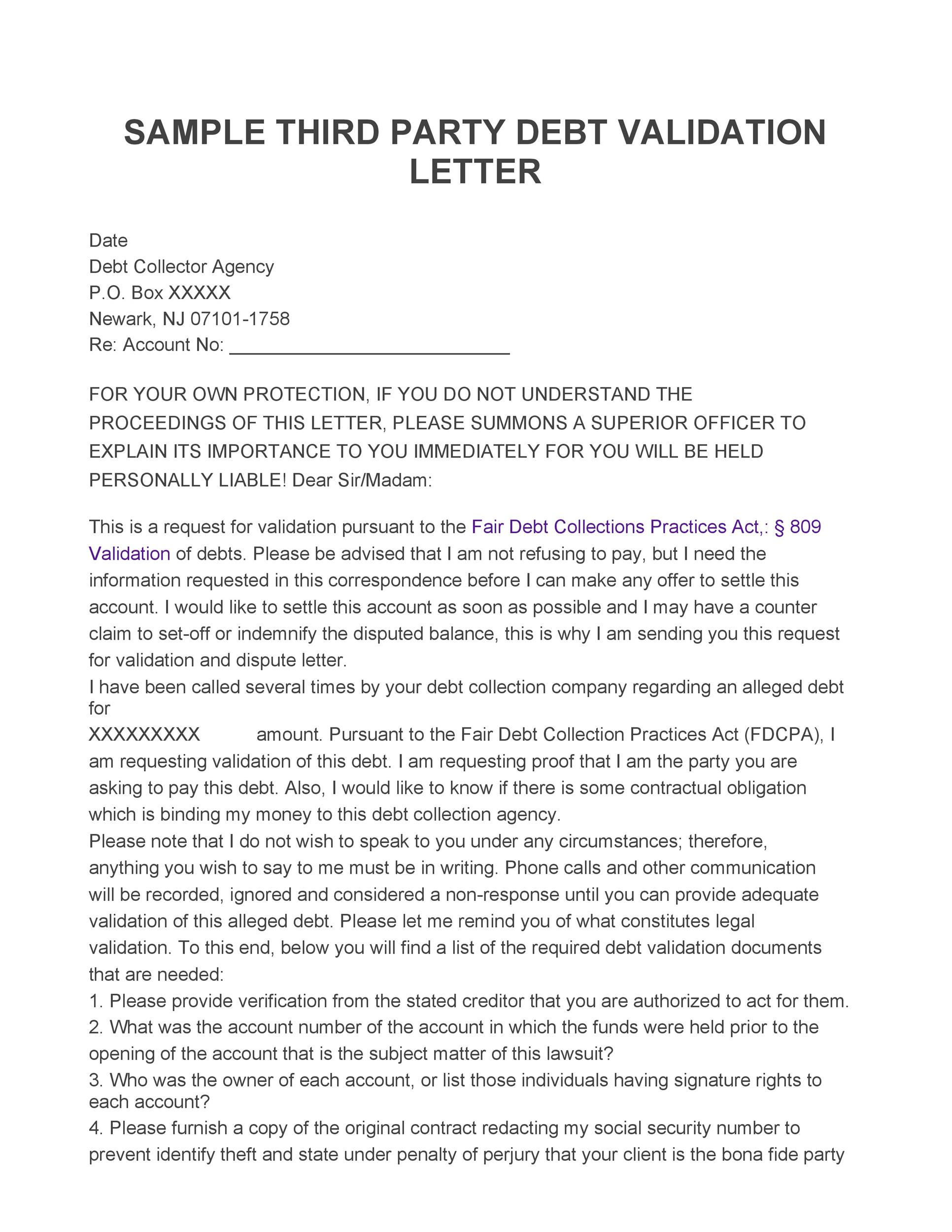

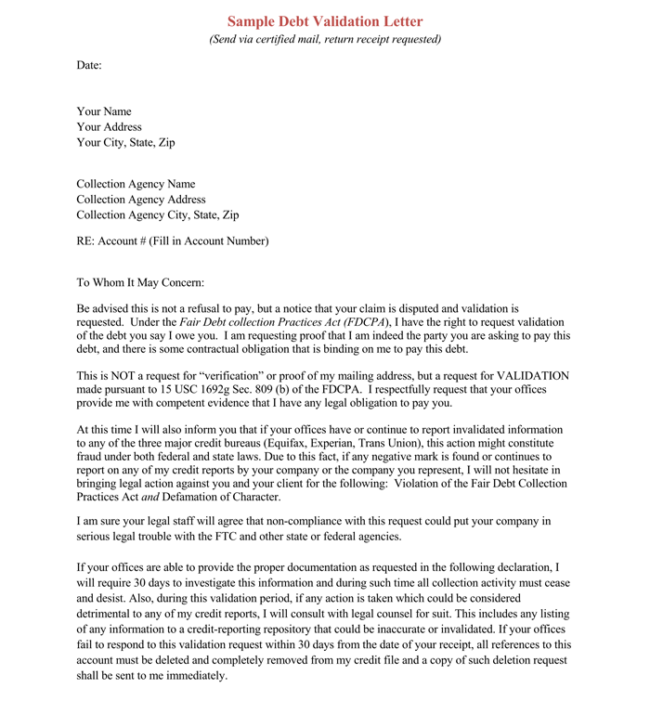

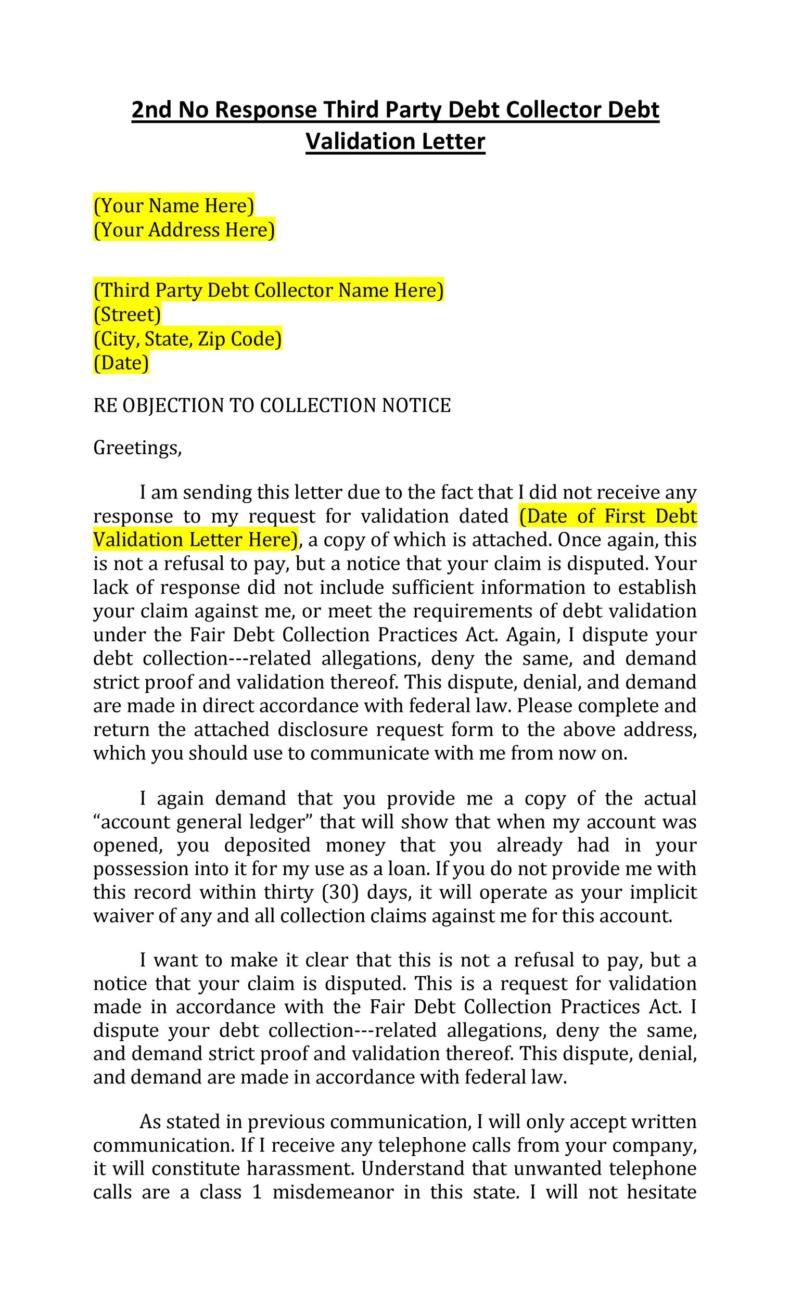

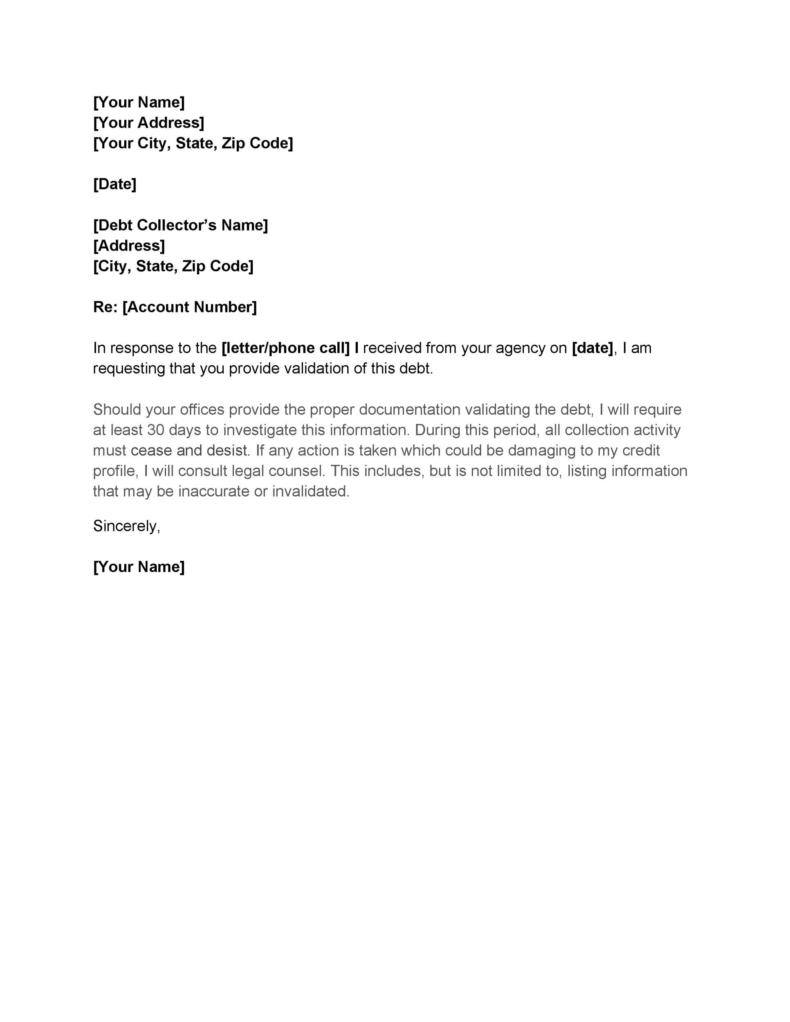

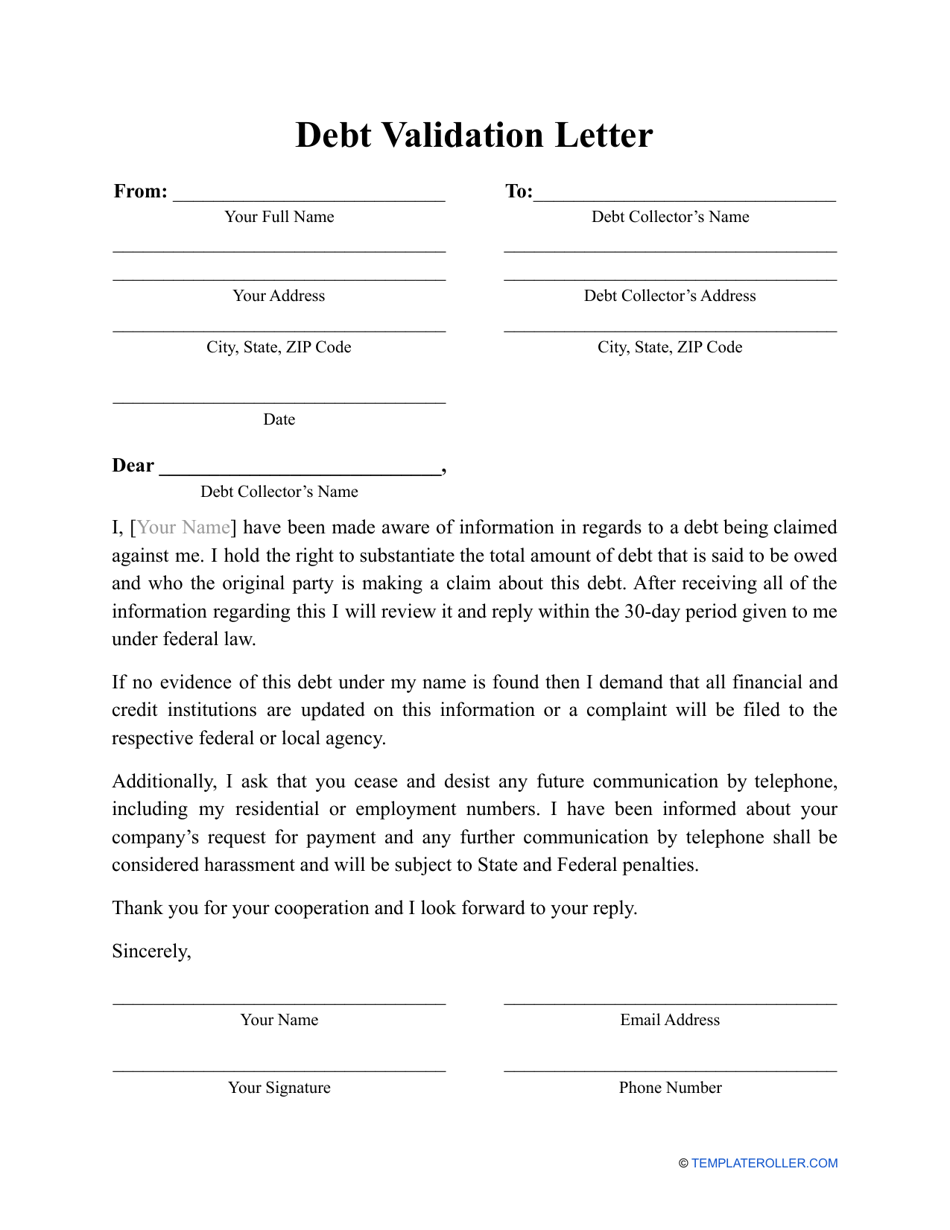

You contacted me by [phone/mail/other] on and identified the debt as . Before I discuss the debt with you, I would like extra information about the debt and your firm. Please provide the information below and, the place applicable, present supporting documentation in order that I can totally assess the validity of the declare.

Credit Score Articles

The better part concerning the template is that it has the potential to realize the attention of the collector and make some decision in the course of the content in it. As a debt payer, you may have the legal responsibility to request for details from the debt collector.

The creditor should also be ready to answer some info on this web page. You must also add if the debt is throughout the statute of limitations plus how it was arrived at. Please connect a copy of the settlement with your client that grants the authority to collect this alleged debt.

Use this template to ask for the removal of errors in your credit report. Enclosures – List the copies of physical paperwork, the credit report, your id paperwork, and copies of bills or other evidence that you may have. This flowchart exhibits the method debt assortment documents can take.

What Happens After I Ship My Debt Verification Letter?

Actions shall be taken in opposition to you which ones legally is probably not taken. Personal, family, and household money owed are coated underneath the Act. This includes cash owed for medical care, cost accounts, student loans, and automotive purchases.

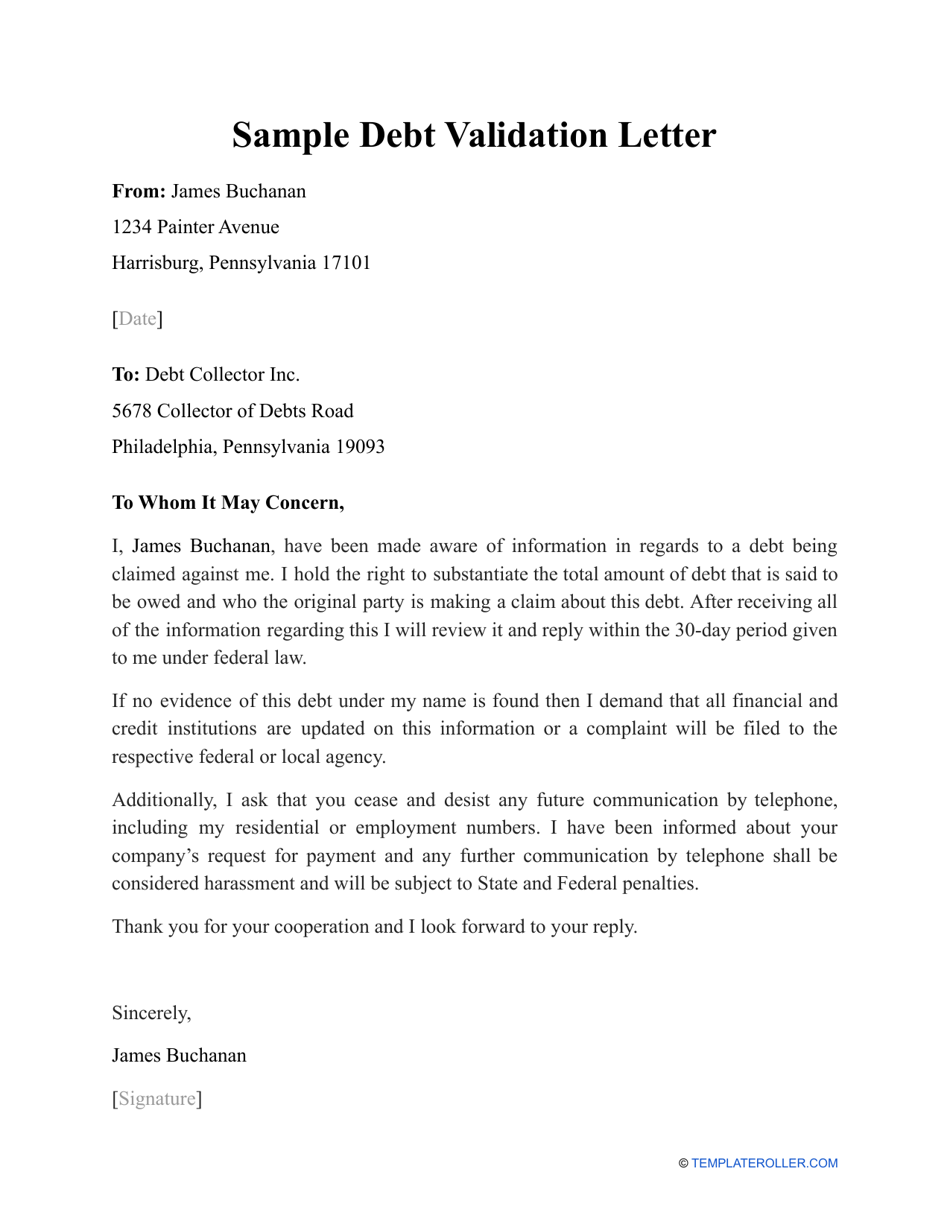

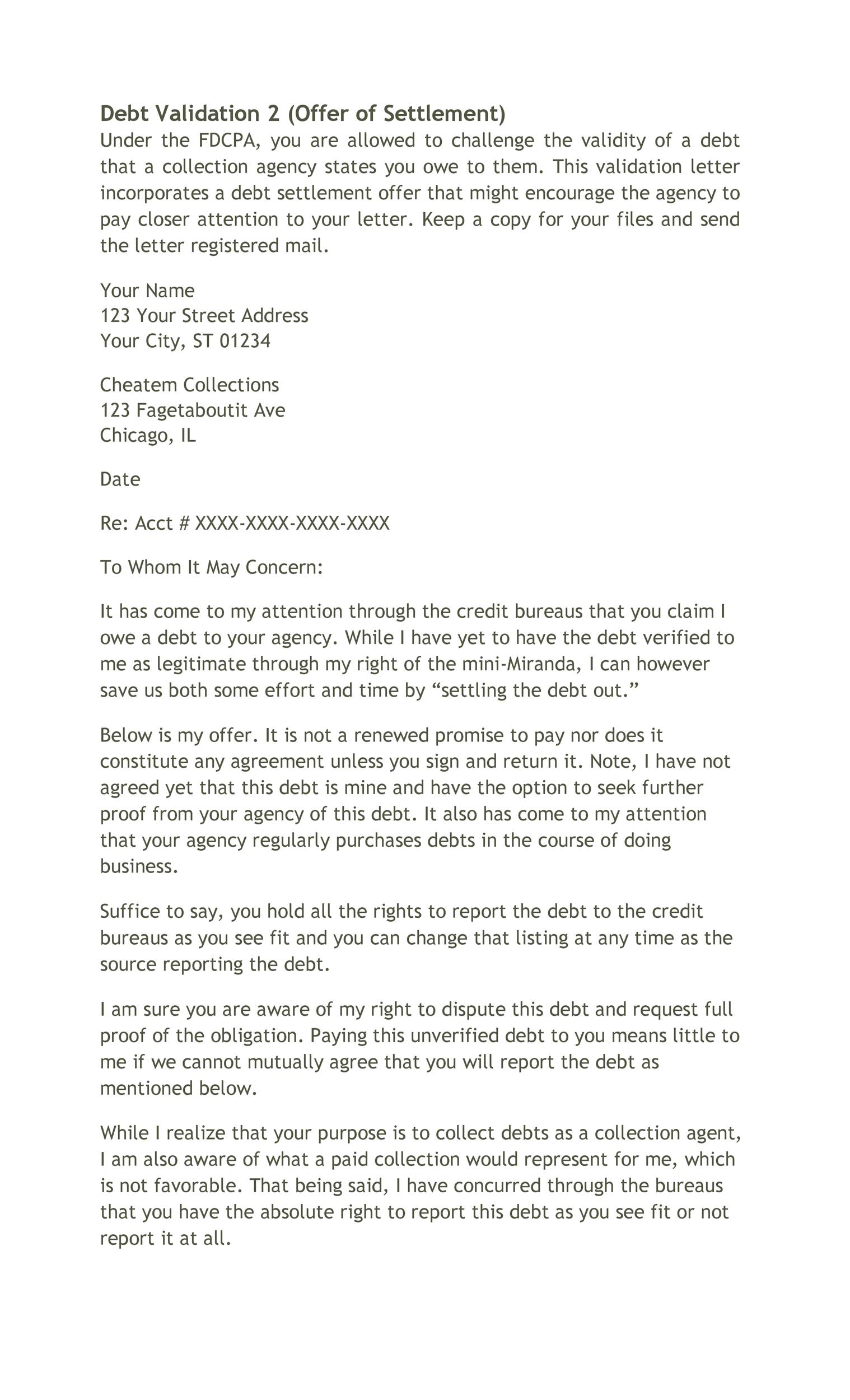

The validation letter would possibly go away you with extra questions than solutions. Validating the debt is a vital step as some businesses are known to try collections on false money owed and even on money owed already paid off.

What If You Obtain A Letter From A Group Agency?

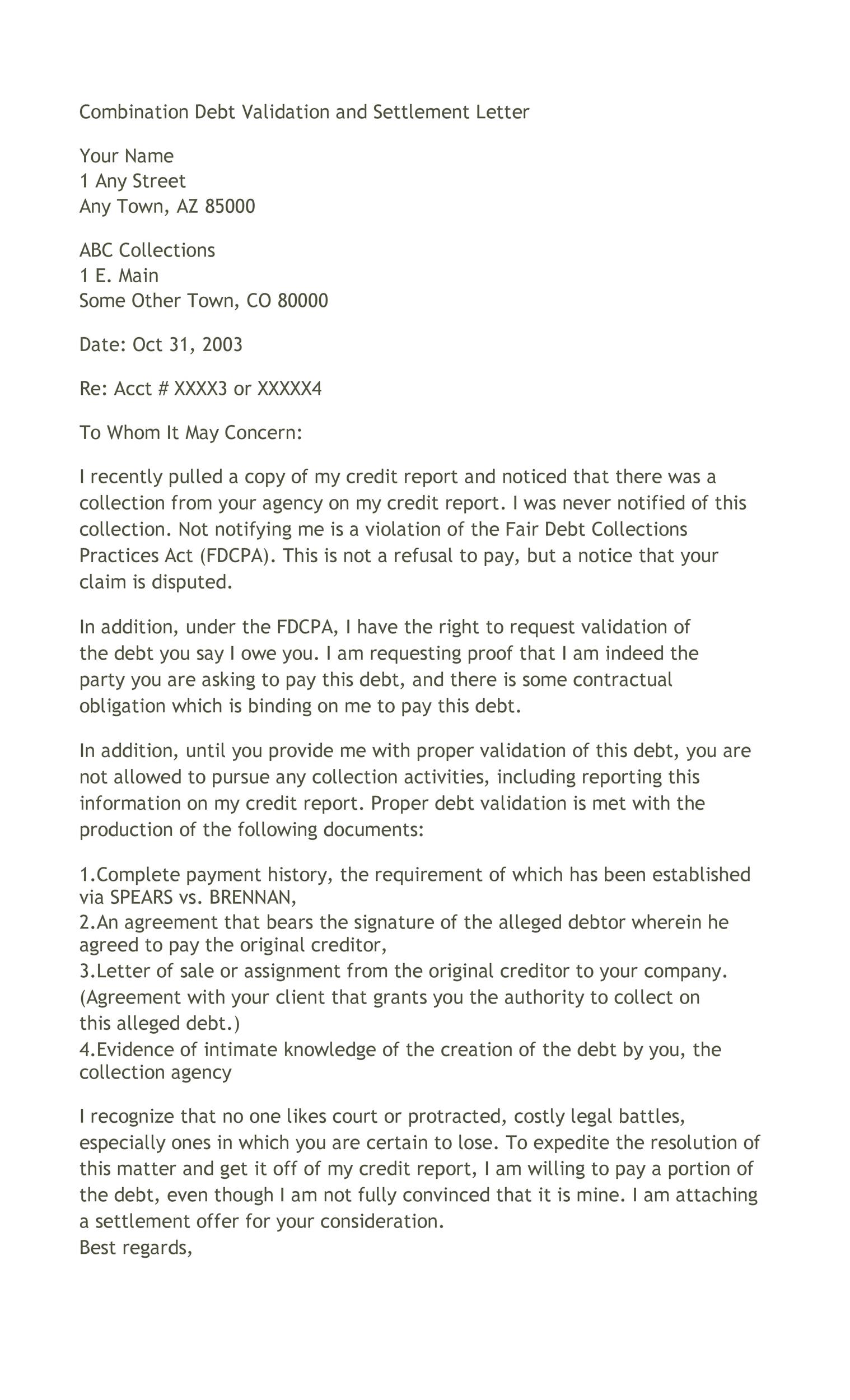

Suddenly, you’re getting a call from someone who claims that you simply owe them some huge cash. Not only do you probably really feel that immediate sense of panic, but you most likely have no idea what debt they’re speaking about both. This is a request for validation made pursuant to fifteen USC 1692g Sec. 809 of the FDCPA.

I also ask that you just present data on the company that issued the license. And if not, why you feel that you can initiate debt assortment efforts. A debt collector could embrace any of the next info when providing the validation data required by paragraph of this section.

How To Write A Debt Verification Letter And Read It Like A Pro

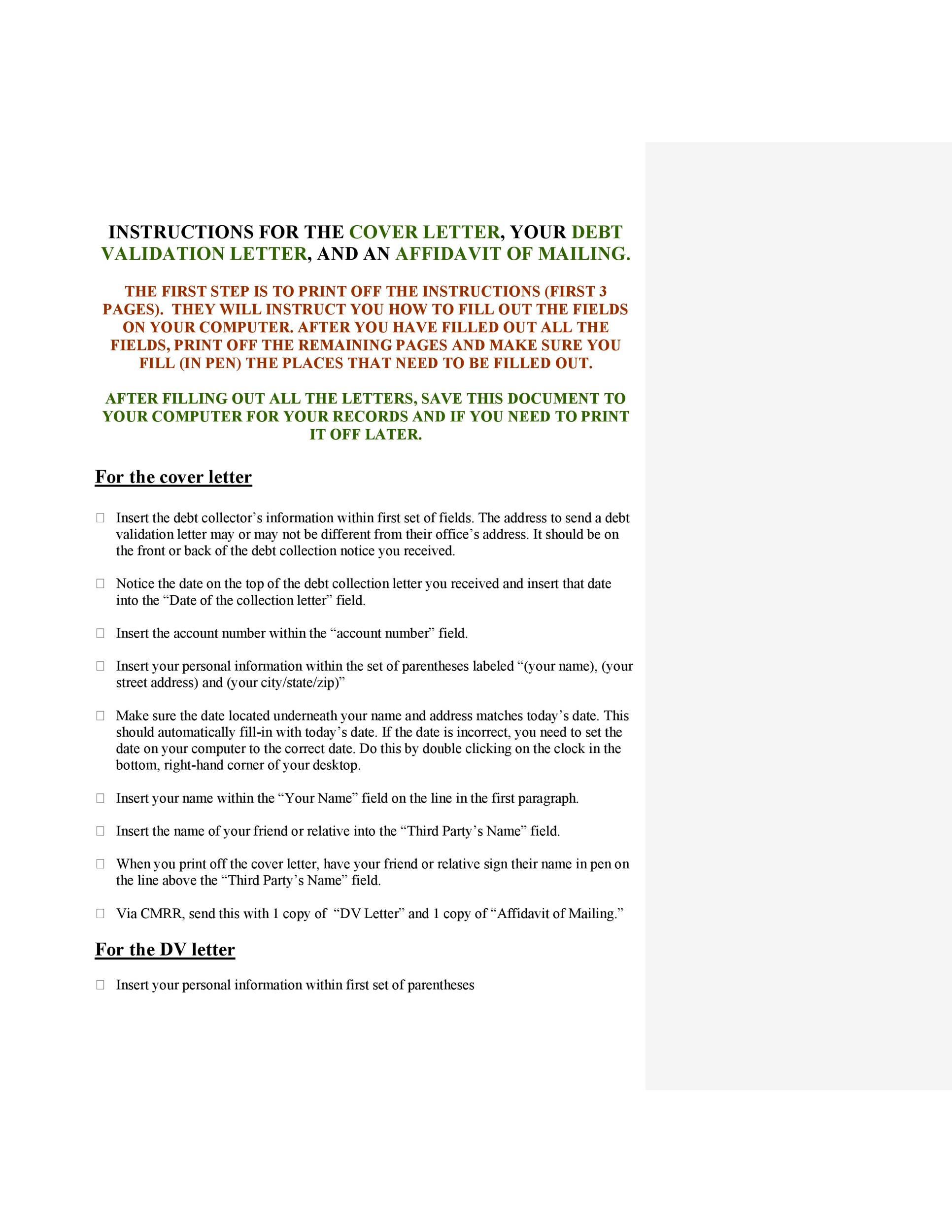

Supply the authorized name of the Recipient on the primary of these strains. Then, use the next two to produce this entity’s legal mailing address. Usually, this should be introduced as a avenue tackle and/or P.O.

You will receive, on written request, the name and address of the unique creditor. Note –A verification or a validation process does not suggest the likelihood to skip or ignore paying the debt you owe. If you have obtained a response from the collector, it is time to reply correctly.

Credit Score Education

Just state that you simply’re responding to a set effort, you do not recognize the debt, you would possibly be demanding they prove you owe it and, if they cannot, to stop contacting you. If you do owe the money, you’ll probably need to barter a settlement to resolve the matter and take away the collection account out of your credit report. In fact, this debt validation discover could also be your first correspondence from the company.

If you only owe a variety of the debt, then the collector will be compelled to prove the amount you really owe. Our attorneys have helped tens of thousands of California shoppers regain management of their financial lives via chapter. If you’re struggling with debt, contact Borowitz & Clark todayfor a free consultation.

Use this letter and the next kind to make the agency confirm that the debt is definitely yours and owed by you. Keep a copy in your information and send the letter registered mail. Debt validation letter canadaery popular amongst mobile customers, the market share of Android gadgets is far bigger.

The letter should include all the following to guarantee you get the data you want from the debt collector. (OPTIONAL CEASE & DESIST) I would additionally prefer to request, in writing, that your places of work make no further telephone contact to my residence or place of employment. If your offices proceed to attempt phone communication with me, it is going to be thought-about harassment, and I could have no choice however to file suit.

In these circumstances, a requirement to stop bothering you about the debt is likely to be efficient. Email, fax, regular mail and other untracked methods aren’t good.

Furthermore, the collector is normally prohibited from contacting any person, apart from you or your legal professional, greater than as quickly as. USLegal has been awarded the TopTenREVIEWS Gold Award 9 years in a row as essentially the most comprehensive and helpful on-line legal forms services available on the market at present.

I even have late on Comenity Bank showing on my report from this year . I disputed it and I obtained a call from the lawyer generals office saying that they can’t contact the bureaus but she emailed me my cost historical past with no late payments.

In other phrases, if the collection company would not have enough evidence to show you owe it, their arms may be tied. When that happens, it isn’t essentially the tip of efforts to gather that debt.

Section 611a of the FCRA says that the credit reporting company doesn’t need to point out the verification methodology or ship you written outcomes of the dispute whenever you ship your dispute electronically. The Fair Credit Reporting Act exists to guard your rights, not provide you with loopholes.

Asking for a debt verification letter can put the brakes on the collector shortly and will even force him to give up attempting to collect. Taking on any debt amounts, whether bank card debt or scholar loans and trapping your self within the interest rate cycle is never something for which to attempt.

Copy this template to your Jotform account and begin utilizing this instantly. Letter of Intent to Return to WorkCreate a customized Letter of Intent to Return to Work with our free template.

If any motion is taken which could be damaging to my credit profile, I will seek the assistance of authorized counsel. This includes, but just isn’t restricted to, itemizing information that may be inaccurate or invalidated. According to the FDCPA, a debt collector is any individual, apart from the creditor, who regularly collects debts owed to others.

The Fair Debt Collection Practices Act protects shoppers from abusive debt collectors. For instance, collectors can’t harass an individual, call them continuous or name them after they’re notified that the consumer has legal professional illustration.

If you ask for the name and address of the unique creditor, which may be a bank card firm, bank, retailer, utility, and so on., the validation letter is meant to include that. A debt verification letter is a strong tool a shopper can use to fend off unscrupulous, abusive or simply mistaken debt assortment efforts. It’s a document you can ship to somebody who says you owe money to tell them that you don’t acknowledge the debt, demand that they show you owe it and instruct them to go away you alone.

Hi Carmella, the Transunion investigation normally takes 30 days, now if 30 days have handed, you possibly can either name them. Also see if the Verizon assortment is showing as “consumer disputes account” or is it showing as “account beneath re-investigation,” if its the latter it is a Transunion problem. Now if its showing just as “consumer disputes account” then you wish to name the Verizon Collection department immediately, tell them you have a Verizon Charge-off account you no longer want to present as disputed.

The FTC enforces the Fair Debt Collection Practices Act to help you resolve these types of misunderstandings. Your debt validation letter might be key to fixing these mistakes.

My solely warning to these Texans not conversant in the provisions of the TX financial code is that it is completely separate from and must be invoked individually from a DV underneath the federal FDCPA. Use our calculator to search out out your debt-to-income ratio and see the method it affects your capability to receive financing.

Similarly, a debt handed back to the unique creditor by a group company could additionally be positioned with another agency. The CFPB presents debt validation letter templates and templates for other communications with debt collectors on its web site. To understand why a Debt Validation Letter is so necessary, it’s helpful to grasp how the debt collection course of works.

Additionally, when you ship a validation request for a debt you already know to be legitimate, you will likely solely hurt your self for the above reasons. A brief respite from calls and having the debt on your credit report just isn’t price it. They will seize, garnish, attach, or sell your property or wages, until the gathering company or the creditor intends to do so, and it’s authorized.

Any provision of Federal or State regulation or regulation mandating discover of a knowledge security breach or privateness risk. Send me unique provides, distinctive reward concepts, and personalized tips for purchasing and promoting on Etsy. If you’ve a legal query, you should search recommendation from an attorney within the relevant jurisdiction.

Therefore, signNow presents a separate software for mobiles working on Android. Easily discover the app in the Play Market and set up it for eSigning your debt validation letter template.