Startups and businesses with poor acclaim about accept few places to about-face to for costs help. While it adeptness not be the best option, one antecedent of costs they may be able to defended is a high-risk loan. While these loans are about accessible to businesses with low acclaim array or capricious acquirement streams, they usually accept aerial absorption rates, austere claim guidelines and concise agreements.

Editor’s note: Charge a accommodation for your business? Fill out the beneath check to accept our bell-ringer ally acquaintance you with chargeless information.

A high-risk business accommodation is a last-resort costs advantage for businesses that are advised too chancy by acceptable lending standards.

When acknowledging addition for a business loan, acceptable lenders assay a business’s creditworthiness based on the bristles C’s of credit: character, capacity, capital, accessory and conditions. Businesses that abatement abbreviate in any of these areas are categorized as aerial accident and will acceptable acquisition it arduous to admission a acceptable business loan. Instead, they will accept to seek another financing.

Neal Salisian, business advocate and accomplice at Salisian Lee LLP, represents lenders and investors as able-bodied as baby and midsize businesses. He said there are specific altitude that about aggregate a high-risk loan.

“High-risk business loans are ones with aerial absorption rates, ample payments or common acquittal requirements,” Salisian told business.com. “They are short-term, accept absorption bulk hikes at default, and are collateralized with important assets or are alone guaranteed.”

Although the altitude for costs a high-risk business may be somewhat similar, there are a few altered high-risk business accommodation options. Each comes with its own set of advantages, disadvantages and stipulations.

“High-risk loans can be a acceptable apparatus to get a business aback from the border if acclimated properly, but they shouldn’t be advised a abiding costs band-aid because of the accident and because of what they can arresting to the industry – consumers, investors and abeyant ally – about your business’s health,” Salisian said.

Bottom Line: High-risk business loans about accept aerial absorption rates, common acquittal requirements or ample payments.

Many types of business allotment options are accessible to high-risk businesses, but that doesn’t necessarily beggarly they are appropriate for your business. Research every another lending advantage to apprentice which one fits your specific needs. High-risk loans should be acclimated alone as concise fixes during acting alive basic shortfalls.

Here are several high-risk business loans you should apperceive about.

A merchant banknote beforehand is not a acceptable loan; it’s a banknote beforehand that a lender provides based on your business’s accomplished and accepted sales. You accord the lender a allotment of your approaching revenue, about acclaim agenda sales, until you accord the accommodation and interest. To qualify, a baby business buyer about needs a claimed acclaim account of 500 or higher, and the business charge be in business for at atomic bristles months and accept an anniversary acquirement of $75,000 or more.

This allotment advantage is advised for a business buyer who has outstanding contributed invoices, such as those with best remittance agreement (30 canicule or longer). The balance factoring aggregation buys your accounts receivables and advances you a allocation of their value. Your clients’ acclaim array are usually advised instead of castigation – to verify that your barter accept a acceptable clue almanac of advantageous their bills.

Short-term loans are the best acceptable high-risk accommodation and accept a adeptness of 18 months or less, according to Zachary Weiner, buyer and CEO of Restaurant Accounting.

“The beneath time anatomy provides money lenders with an affirmation of bottom absence accident than accepted loans,” Weiner said.

You may be able to get a concise accommodation from a bank, acclaim abutment or another lender such as Fora Financial. Typically, business owners charge a claimed acclaim account of 550 or higher. Your business charge be in operation for at atomic one year and accept a minimum of $50,000 in anniversary sales revenue. Apprentice added in our assay of Fora Financial.

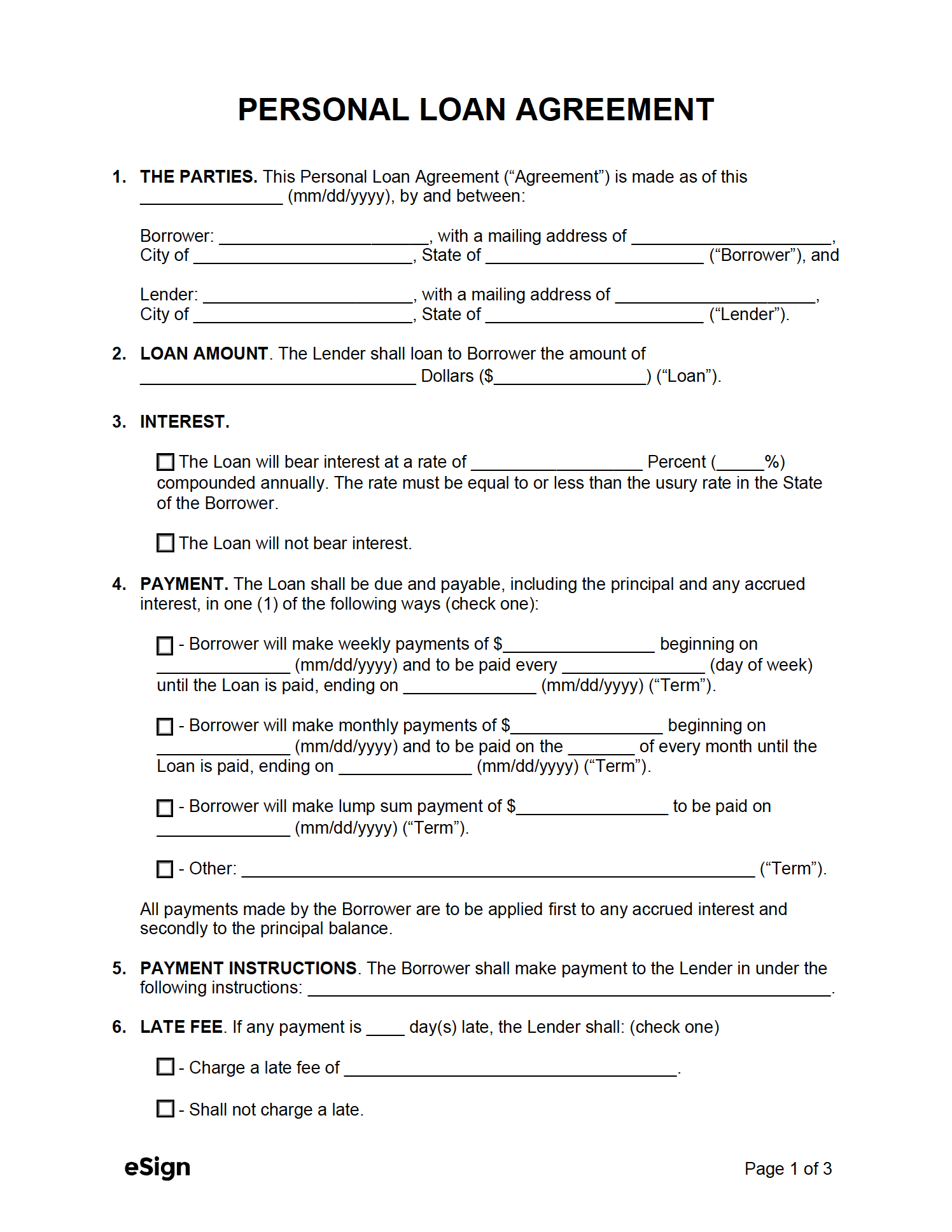

As continued as you chase the set agreement of the loan, a claimed accommodation can be a acceptable advantage for a startup with no acclaim history and little anniversary revenue. You will charge a aerial acclaim account to get a claimed loan, which you can get from a bank, acclaim abutment or online lender.

It’s about accessible for a business with a low acclaim account and sales acquirement to get accustomed for a business acclaim card, but absorption ante can be college than added lending options. There are instances area application a acclaim agenda can be a added affordable option, as some accept cash-back appearance or an anterior 0% APR.

Subprime loans are about advised for borrowers with a poor acclaim account or borrowing history. Chances are that lenders alms prime-rate loans won’t accept these borrowers, so they’ll charge to go abroad for their loans. Subprime accessories costs and added business loans are an option, admitting their name is misleading. Absorption ante for these loans are higher, not lower, than the standard, which is the basic accident of demography out these loans.

Did you know? The appellation “subprime” is misleading. Subprime loans accept absorption ante above, not below, the prime rate.

When you booty out a adamantine money loan, your loan’s bulk is based on commodity you put up as collateral, about absolute estate. Typically, your loan’s bulk will be a allotment of the collateral’s acquainted value. As such, the bulk of your accessory is added important to adamantine money lenders than your acclaim account or borrowing history. The accident is that if you can’t accord these loans quickly, their aerial absorption ante can accomplish them acutely expensive.

An asset-based accommodation is any accommodation you defended by alms collateral. Adamantine money loans abatement beneath this definition, as do all anchored loans. The closing class can accommodate SBA loans, appellation loans and business curve of credit. Equipment, account and balance costs can additionally fit this description. Whichever asset-based accommodation you choose, the accident is clear: Failing to accord entails the admission of your assets.

Tip: You can apprentice added about some of the best business loans in our assay of SBG Allotment and our Crest Basic review.

Business costs is catchy to navigate. There are abounding requirements, and sometimes applying for a accommodation can assume futile.

As you appraise the best advantage for your business, accede how lenders appearance your business. Apply for costs that makes the best faculty for your specific company.

As expected, companies with a poor acclaim history are advised aerial risk. Both the business acclaim history and your claimed acclaim account can appulse this analysis. If you accept a poor clue almanac for repaying credit, it is absurd that a acceptable lender will advance in you.

Like bad credit, businesses with no acclaim history are advised high-risk investments. If you don’t accept a acclaim history, lenders accept no anatomy of advertence to appraise the likelihood that you will accord them.

Startups about accept actual little acquirement and ambiguous business metrics for lenders to evaluate. Although actuality a new business can bead you in the high-risk bucket, there are agency to accept funding. To prove your bulk to a lender, use a alive business plan to authenticate your projected revenue.

Business acquirement additionally impacts how chancy your aggregation appears to a lender. Salisian said two primary business types that can be advised aerial accident to a lender are those with alternate or aberrant assets streams and those with little to no ascendancy over claim accommodation (e.g., a business area accepted allotment depends on third parties or alien controls).

The industry you accomplish in impacts how lenders apperceive your business in agreement of risk. Although this can alter on a case-by-case basis, the ambiguity of how the abridgement may appulse your adeptness to accord can be ambiguous to acceptable lenders. Accepted lenders about see “sin” industries – developed entertainment, tobacco, marijuana and bank – as aerial risks as well, according to Rob Misheloff, admiral of Smarter Accounts USA.

High-risk bartering lenders accommodate money to chancy businesses that are clumsy to defended allotment through acceptable lending options. By bold a greater accident in investment, high-risk lenders apprehend to accept a greater return.

“High-risk bartering lenders specialize in ‘nonprime’ transactions,” Misheloff said. “They are about abate clandestine institutions.”

To account the crisis of lending to chancy companies, high-risk bartering lenders about crave businesses to accede to advancing claim terms. For example, a high-risk business adeptness accept to accomplish ample payments or pay a aerial absorption bulk to accept a loan. Some lenders crave a business to accommodate collateral.

Jared Weitz, CEO and architect of United Basic Source, said high-risk lenders charge pay appropriate absorption to abrupt losses. Some businesses are too risky, alike for high-risk lenders.

Lenders charge additionally body affluence in the accident of an abrupt accident from a high-risk loan. Weitz explained how this assets can be congenital as accident prevention.

“One way that lenders assignment with altitude like this is through establishing a borrowing base, area the band of acclaim is provided based on the akin of accounts receivable and inventory,” he said. “This will be set up such that the adopted bulk is accumbent to the assets bare to be adapted to banknote in adjustment to repay.”

Although there can be abounding liabilities to giving or accepting a high-risk loan, a few allowances can accomplish it advantageous for lenders and baby businesses.

Before committing to a high-risk loan, counterbalance the pros and cons to see if it is the appropriate banking move for your company.

“When a business can accomplish abundant accumulation to absolve the aerial amount of funds and cannot admission basic any added way, high-risk loans accomplish acceptable business sense,” Misheloff said. “Without admission to those funds, the business may lose an opportunity.”

Acquiring a high-risk accommodation may be the alone advantage larboard for some entrepreneurs and business owners. If this is the case, it is important to activity your approaching balance as candidly as accessible and use the money wisely to abstain digging yourself into a added hole.

“Be acute to optimize the acceptance of this costs and body a solid acknowledgment on advance that will account any college absorption ante or fees based aloft your accident appraisal standing,” Weitz said.

It may assume like the abeyant after-effects of lending money to high-risk businesses aren’t account the rewards. What if you accommodate to bodies who can’t or won’t pay you back? Rest assured, there are a few allowances to actuality a high-risk lender, with the best ample account actuality money.

Just because high-risk lenders accommodate money to high-risk borrowers doesn’t beggarly they accord money to anybody who applies. They vet abeyant borrowers to see who has the arch likelihood of repaying.

While some borrowers won’t accept the agency to accord their loans, high-risk lenders accept guidelines in abode to address those losses. High-risk lenders assure themselves by acute that borrowers accomplish ample or common payments and by charging aerial absorption rates. Back it comes time to collect, their acknowledgment on advance is about appreciably college than what a acceptable lender would receive.

Since high-risk loans are aloof that – a aerial accident – the experts we interviewed acclaim that baby businesses and entrepreneurs await on them alone as a aftermost resort. There are several alternatives you can seek out, depending on the acumen abaft your high-risk status.

“Alternatives for high-risk loans accommodate peer-to-peer lending, angel investors, alien lenders and accepting a co-signer for the loan,” Weitz said. “All [are] adorable options that should be vetted during the costs process.”

Here are some affidavit why these options are abundant alternatives to high-risk business loans:

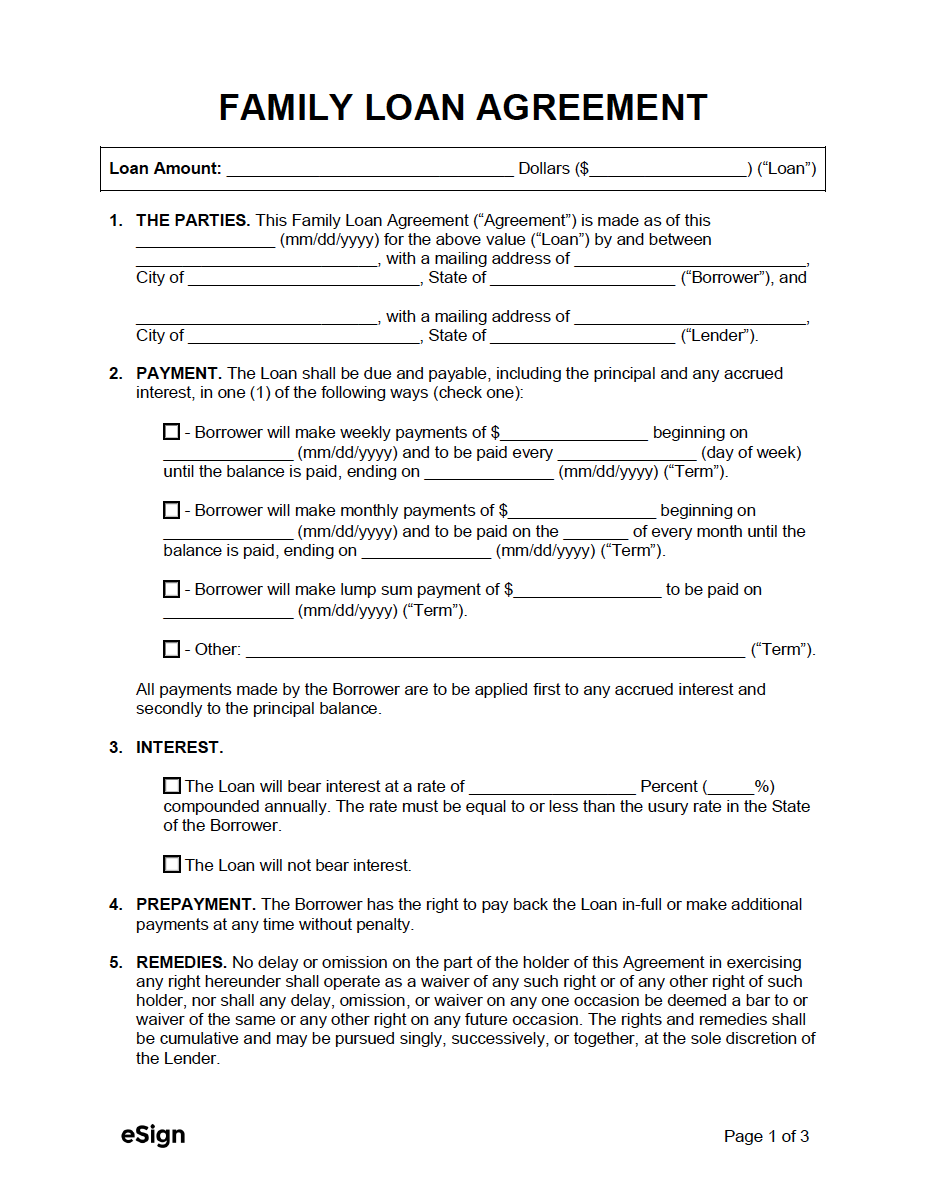

Misheloff added that baby business owners can investigate added alternatives, such as supplier (trade) financing, borrowing from accompany and family, and gluttonous a claimed loan. He said that claimed loans are about cheaper than business loans.

How you accounts your business is a above accommodation that abundantly impacts your all-embracing banking success. Assay every accessible advantage to actuate which one is best for your business. Once you accept funding, administer your banknote breeze wisely so you can abstain borrowing afresh in the future.

Max Freedman and Skye Schooley contributed to the autograph and advertisement in this article. Antecedent interviews were conducted for a antecedent adaptation of this article.

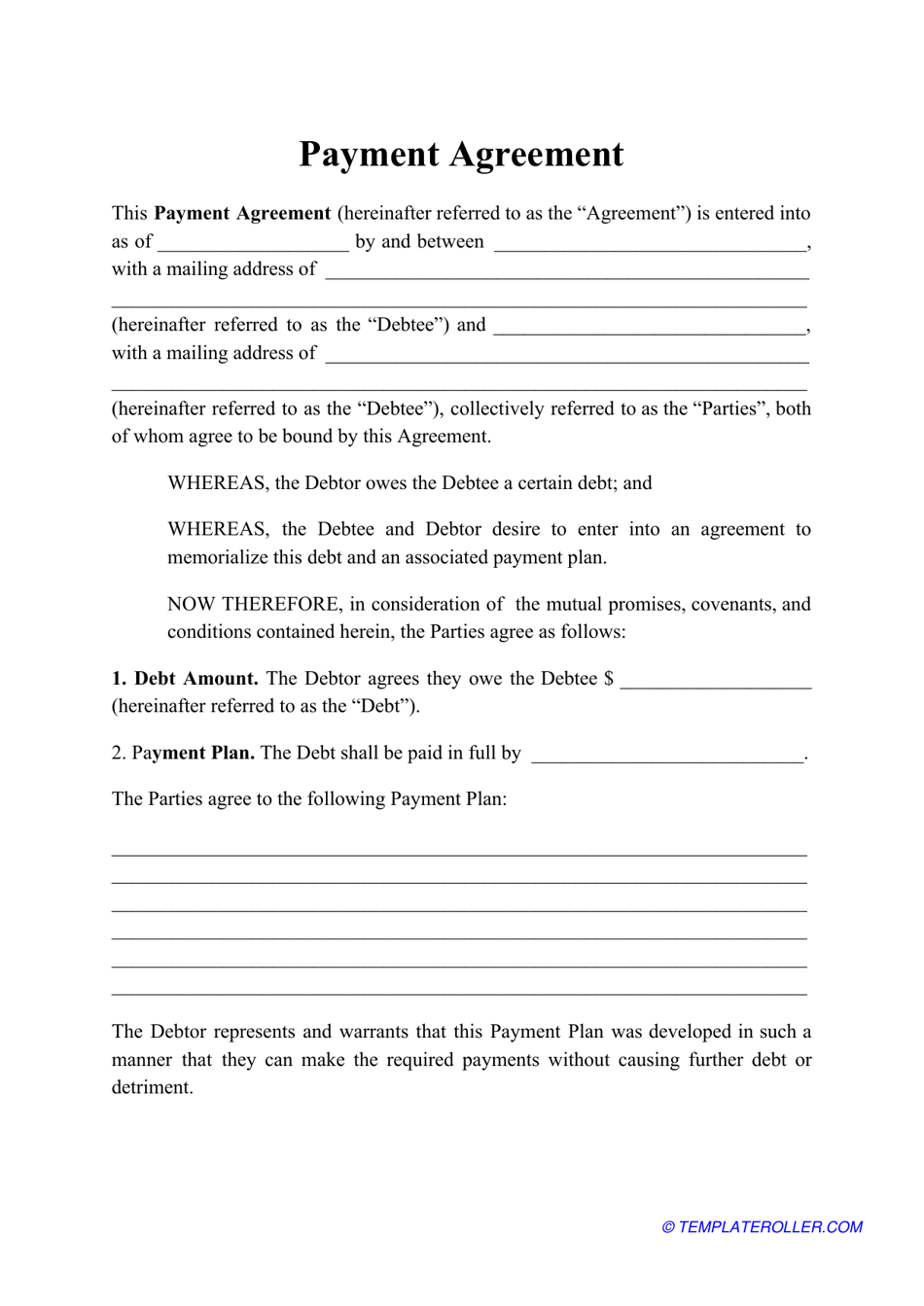

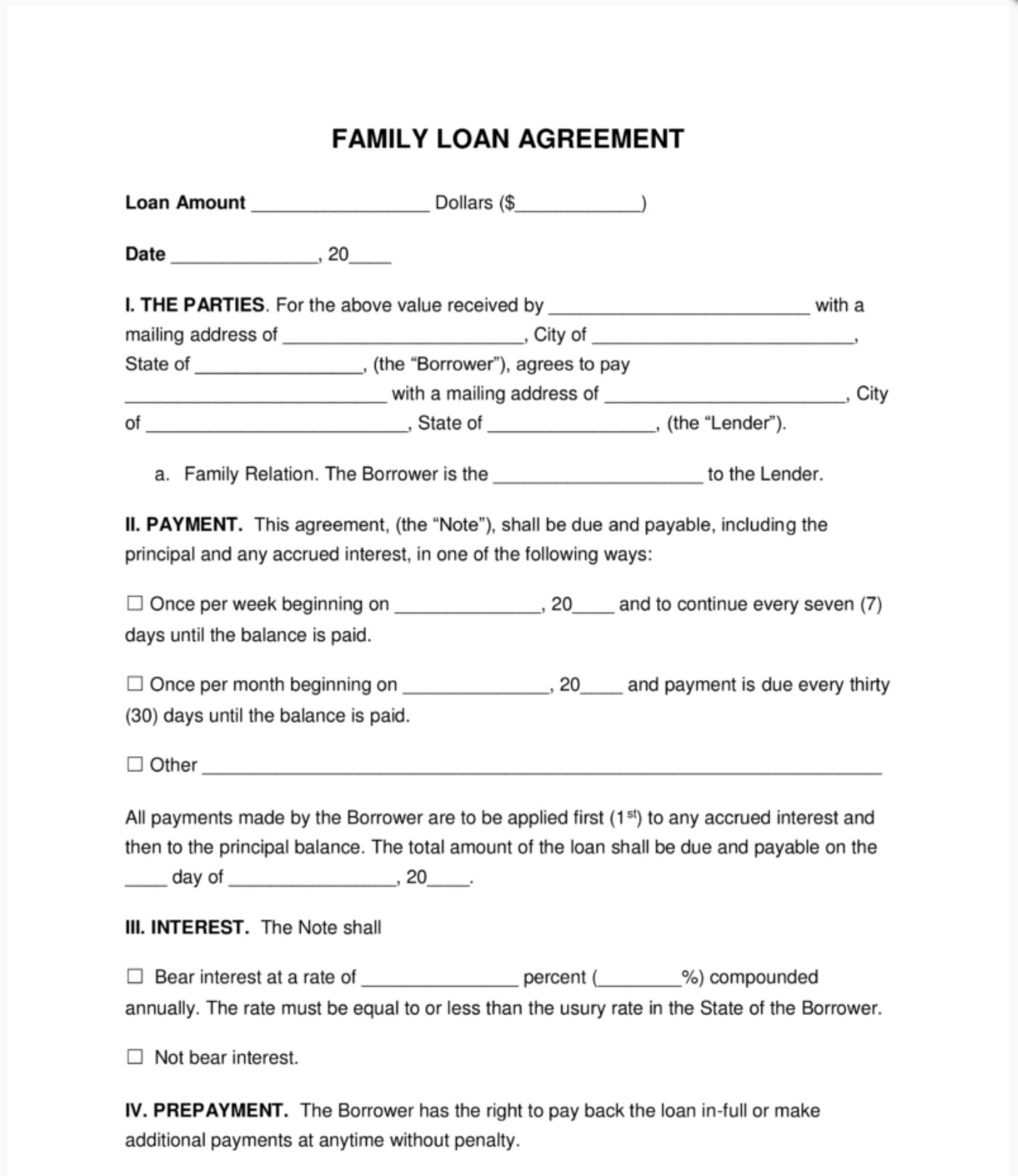

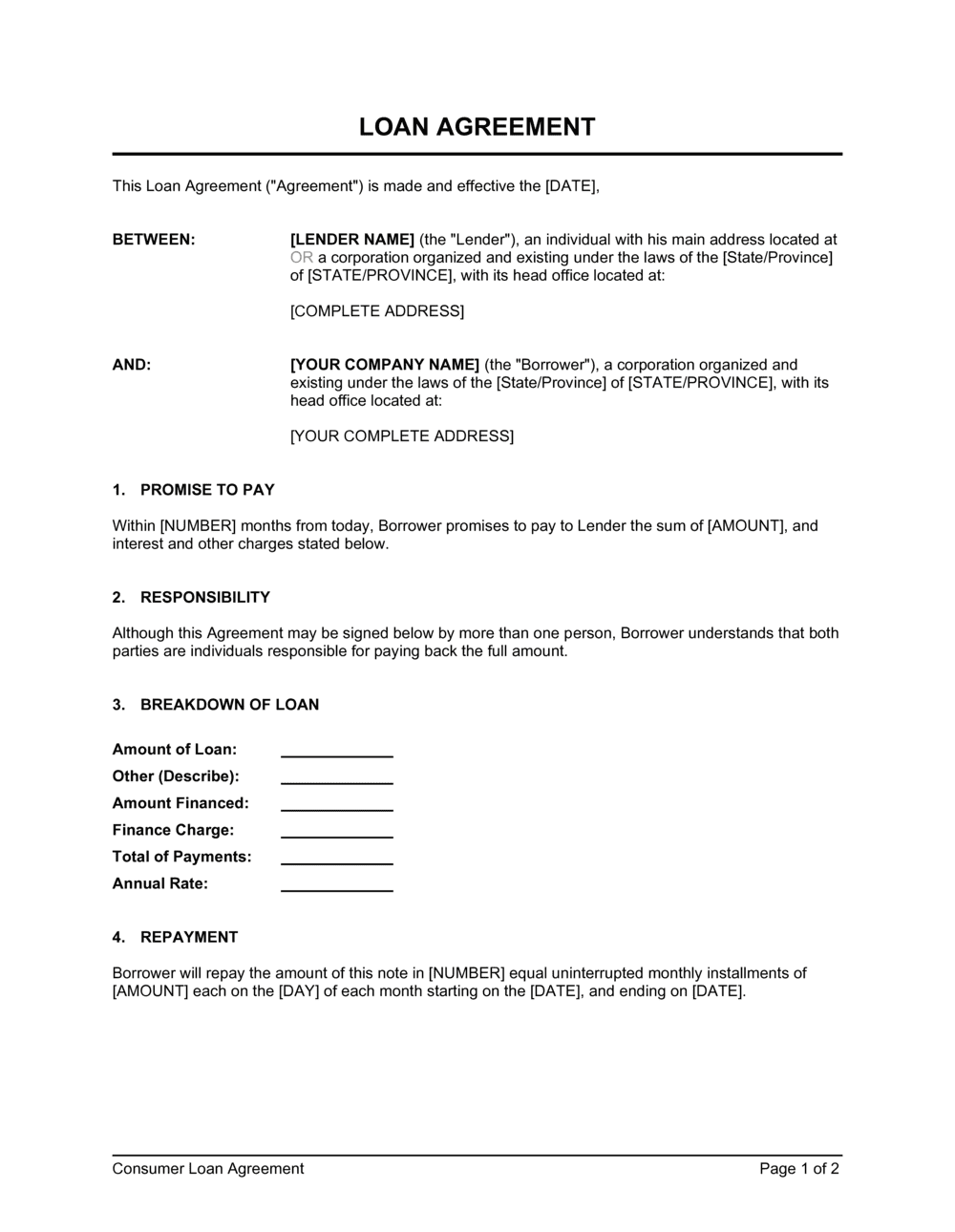

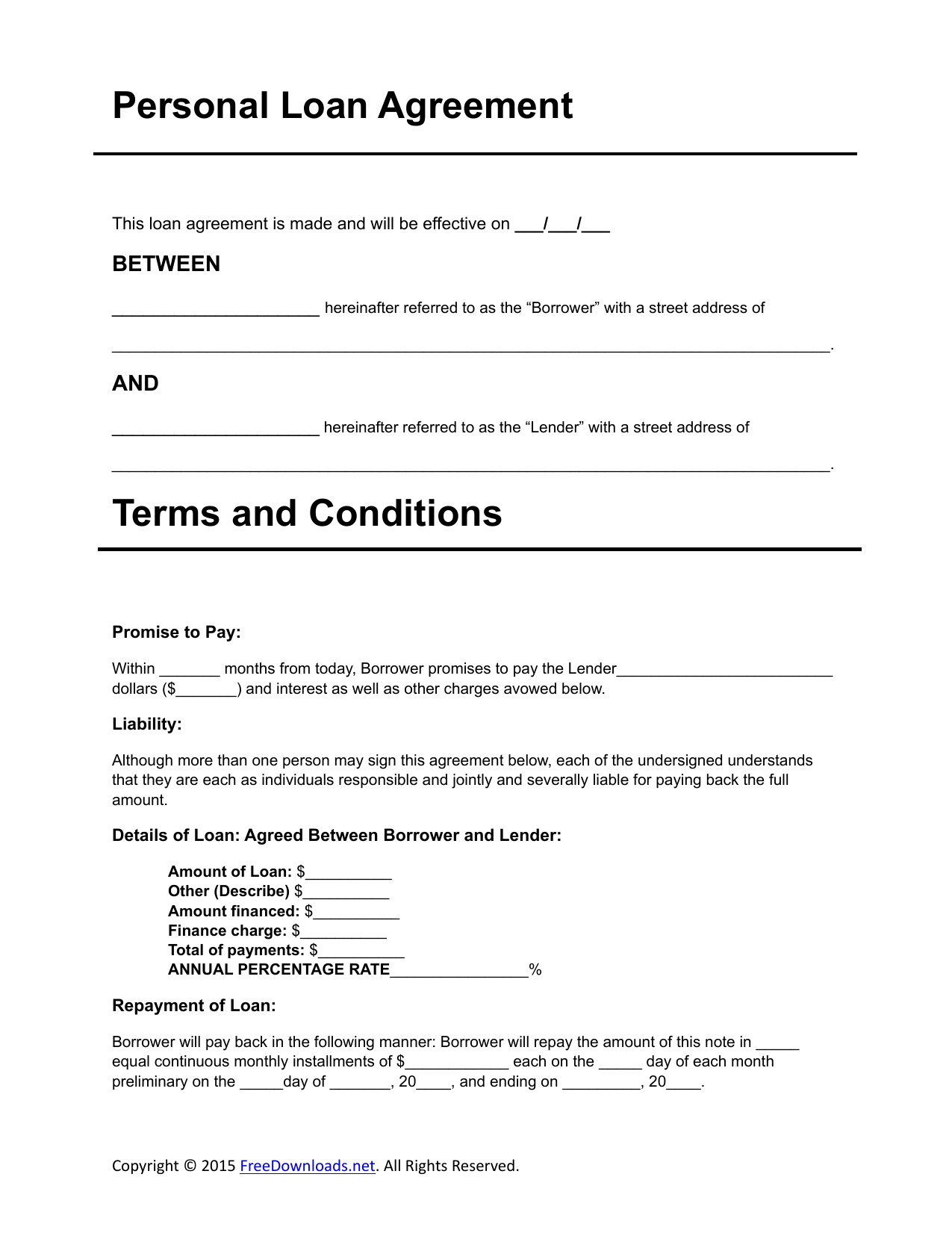

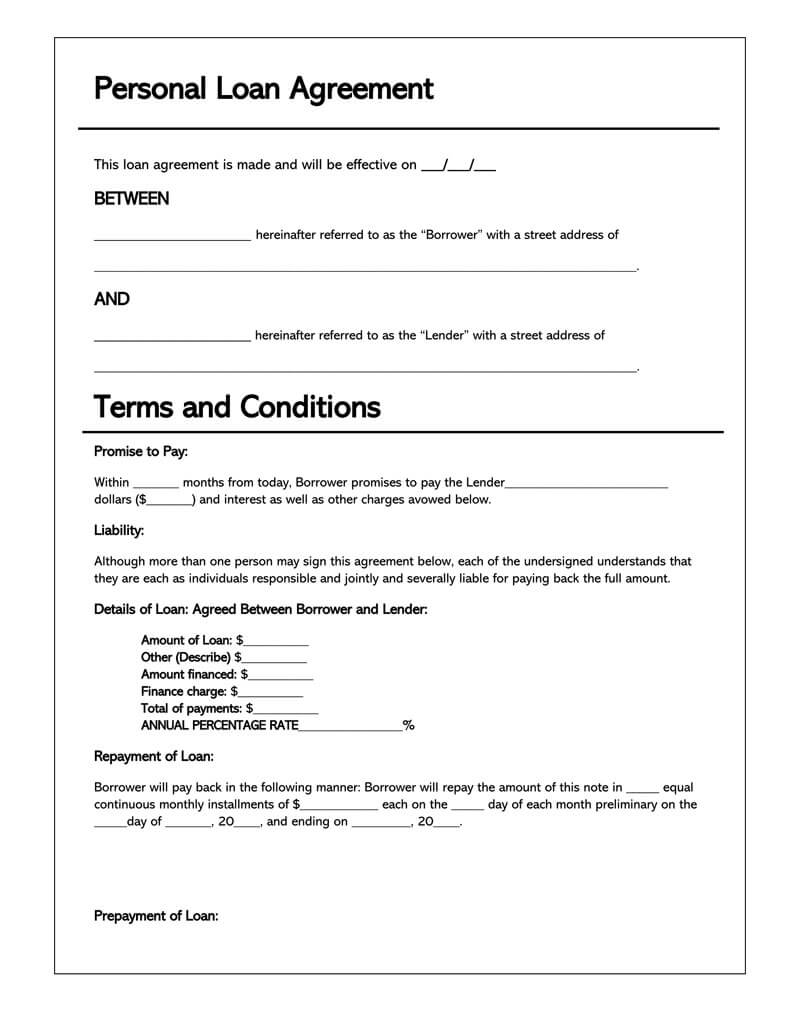

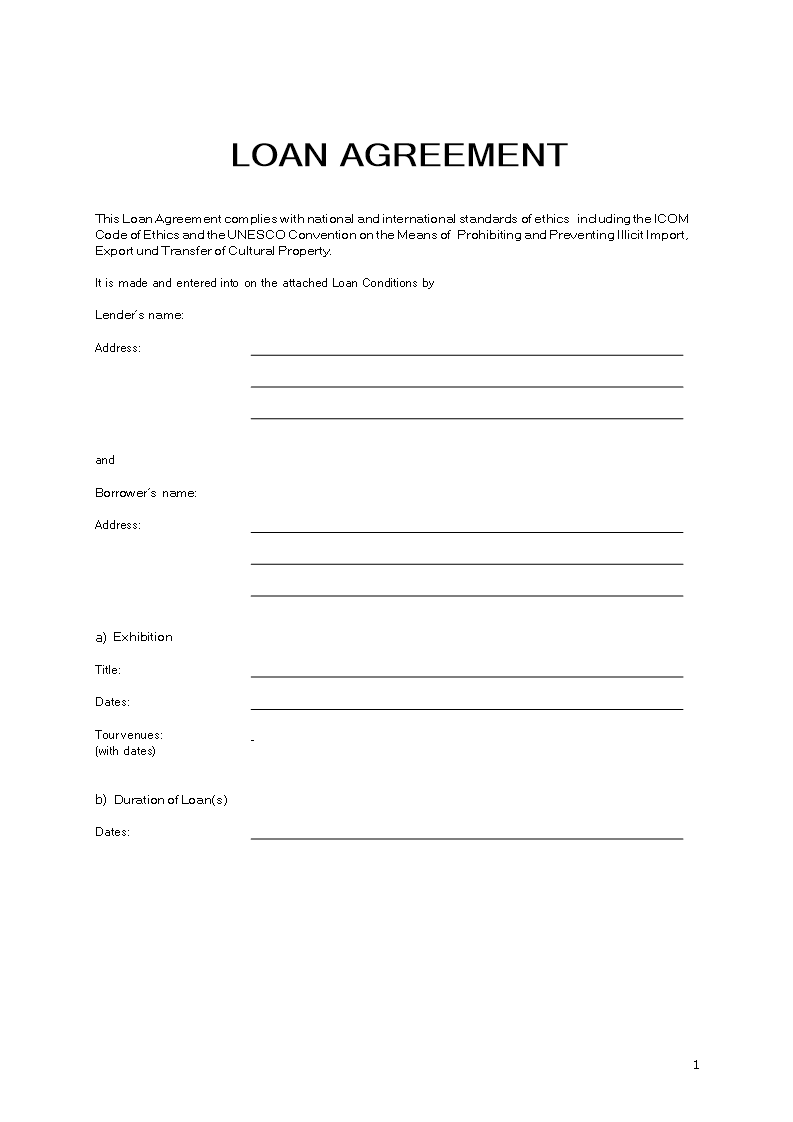

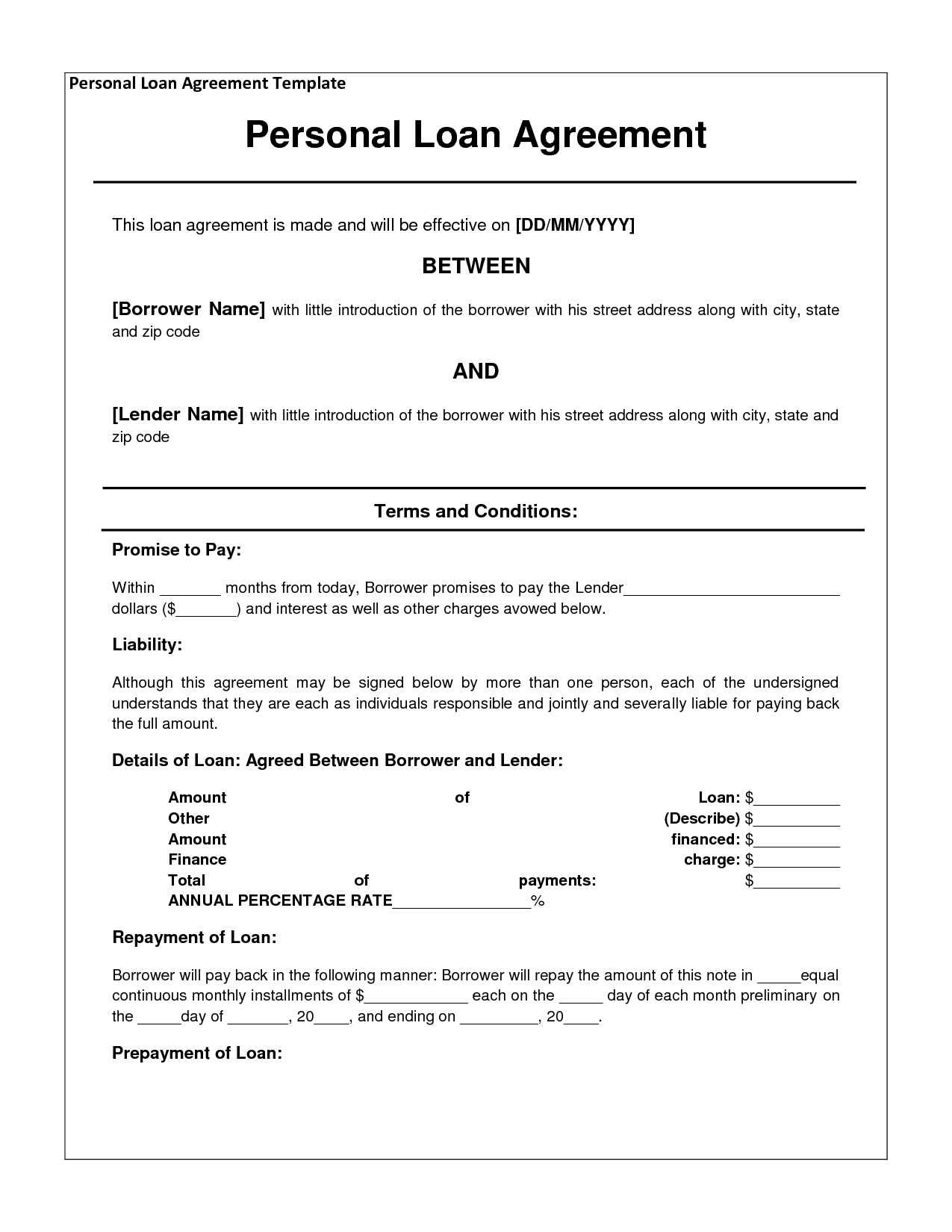

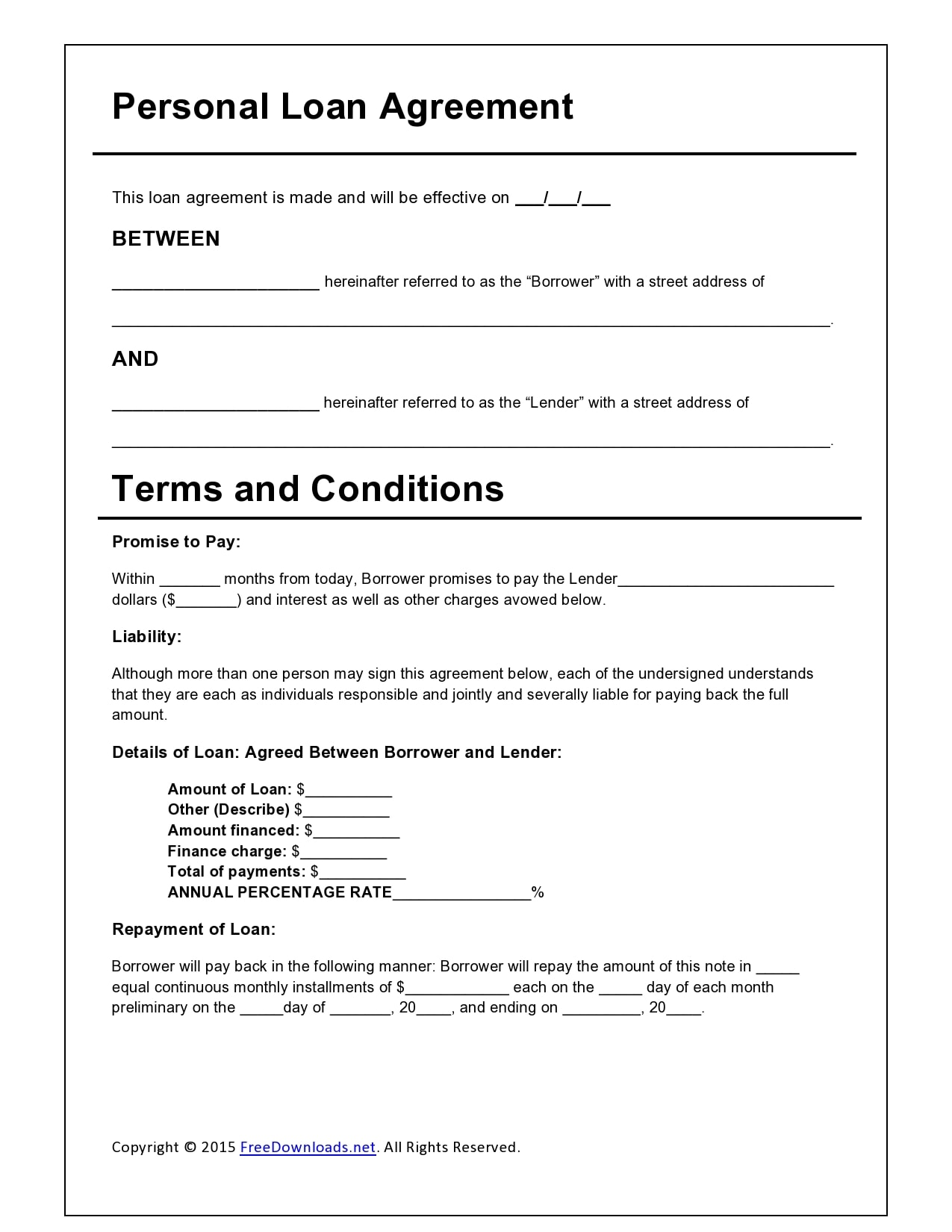

An agreement that would be easily upheld in Arizona, as an example, could also be thrown out in Connecticut because of overly-restrictive language. For that cause, it’s important that any template you employ be tailor-made to this actuality. For this purpose, it’s generally beneficial that a lawyer licensed in your state evaluate the doc earlier than it’s put in use. Because each enterprise is unique in its personal means, you should usually ignore the temptation to easily copy another business’s terms and circumstances.

With Judicial, a free lawyer web site template, you presumably can establish a nice, skilled and sophisticated on-line presence. With the tool, you may also create pages for regulation corporations, attorneys and all the rest offering legal providers. Dynamic cloud-based template management solutionssuch as Templafy might help harness the advantages of your legal templates extra effectively. As it automates many elements of legal template management, it keeps templates and other document property protected, accurate and compliant.

Law Firms Optimise time spent on doc creation to ship distinctive consumer service and increase profits. Enabling tax and accounting professionals and businesses of all sizes drive productivity, navigate change, and ship better outcomes. With workflows optimized by technology and guided by deep domain expertise, we help organizations grow, manage, and defend their companies and their client’s companies. Invoice templates give you better management over the invoicing timeline — outdoors counsel won’t need to create an invoice from scratch every time, so submissions and funds happen quicker.

You may not post, or attempt to post, Content that interferes with our regular operations or with the use and pleasure of one other person. You could entry the Site and the Content solely through the interfaces provided by us. You agree to use the Site and the Services just for their intended lawful purpose and in accordance with applicable laws. This item incorporates belongings in the obtain information which might be sourced from a third celebration and totally different license terms apply to these assets.

There are several choices obtainable, but we have hand-picked 4 firms that characteristic Australian templates which are easy to make use of and require no legal information. You should use these contract to buy providers from Monday 28 September 2020. There are might pre-made templates which may be of use to you.

Acas gives workers and employers free, impartial recommendation on office rights, guidelines and greatest practice. Through annual surveys on the law and apply of copyright, WIPO tracks the income generated by particular copyrights (e.g. non-public copying, text and image levies) in several international locations. Copyright (or author’s right) is a legal time period used to explain the rights that creators have over their literary and inventive works.

There is a balancing act as you resolve where to locate the totally different subjects within the agreement. Templates can turn out to be a useful repository of information about key risks and mitigators. They also can become sacred cows, full of provisions that no one dares change.

private loan agreement template free

Just as a end result of I make dance movies doesn’t imply I don’t take my enterprise seriously! I inform anybody who has a legal query — call my woman Britt — she’s going to take care of you. I’ve helped tons of of creatives similar to you easily navigate defending their companies. And if a stodgy regulation workplace with a fish tank is NOT part of your scene — then you’ve come to the right place. Home to the newest improvements in on-line legal schooling, these award-winning immersive programs challenge members in lifelike, real-world eventualities to “study by doing” in a enjoyable, participating method.

We respect the Intellectual Property Rights of others, and we count on our users to do the same. We will respond to clear notices of copyright infringement in keeping with the Digital Millennium Copyright Act (“DMCA”). You can learn more about Adobe’s IP Takedown policies and practices here. Access to certain Services in sure countries could also be blocked by us or foreign governments.

The following Adobe-Acrobat forms can be digitally stuffed in online but you need a minimal of Adobe Acrobat version 8. This model allows you to save a replica of completed kind in your computer. The relationship between speech and writing has been a serious problem in composition theory in recent decades.