A aggregation is endemic by its shareholders. The shareholders accredit the admiral who again accredit the management. The admiral are the “soul” and censor of the company. They are accountable for its actions. Shareholders are not accountable for aggregation actions. Administration may or may not be accountable for aggregation actions. About these roles are affected by the aforementioned individuals but as a aggregation grows and becomes larger, this may not be the case. Aback a aggregation is created, its founding shareholders actuate how a aggregation will be endemic and managed. This takes the anatomy of a “shareholders agreement”. As new shareholders admission the picture, for archetype angel investors, they will appetite to become allotment of the acceding and they will best acceptable add added complexity. For example, they may appetite to appoint vesting acceding and additionally mechanisms to ensure that they ultimately can avenue and get a acknowledgment on their investment. Not accepting such an acceding can advance to austere problems and disputes and can aftereffect in accumulated failure. It’s a bit like a prenuptial agreement.

Companies charge accede with the law. Companies are congenital in a accurate administration (e.g. State, Province or Country) and charge attach to the applicative legislation, e.g. the Canada Business Corporations Act, or the B.C. Corporations Act. This legislation lays out the arena rules for accumulated babyminding – what you can and cannot do, e.g. who can be a director? can a aggregation affair shares? how can you buy or advertise shares? etc. Aback a aggregation is formed, it files a Memorandum and Accessories of Incorporation (depending on jurisdiction) which are accessible abstracts filed with the Registrar of Companies. A shareholders acceding is arcane and its capacity charge not be filed or fabricated public.

When a aggregation is formed, its shareholders may adjudge on a set of arena rules over and aloft the basal legislation that will administer their behavior. For example, how do you handle a actor who wants “out” (and advertise her shares)? Should it be accessible to “force” (i.e. buyout) a shareholder? How are disagreements handled? Who gets to sit on the Board? What ascendancy is accustomed to whom for assorted controlling activities? Can a actor (i.e. aggregation founder) be fired? And so on…

A aggregation which is wholly endemic by one actuality charge not acquire such an agreement. However, as anon as there is added than one owner, such an acceding is essential. The spirit of such an acceding will depend on what blazon of aggregation is contemplated. For example, a three-owner retail boutique may acquire a absolutely altered admission to that of a aerial tech adventure which may acquire abounding owners. Aback a aggregation has hundreds of shareholders or becomes a “public” company, the charge for such an acceding disappears and the applicative Act and balance regulations again booty over.

Corporate Governance

There is no acting for acceptable accumulated governance. Even baby companies with few shareholders are bigger served by acceptable babyminding practices. Instead of aggravating to ahead every accessible approaching accident or aggravating to be ever prescriptive, a anatomy that ensures the accession of an accomplished lath of admiral is arguably the best approach. Why? Because admiral are amenable to the aggregation – NOT to the shareholders as is frequently thought. If admiral add agilely with this mandate, abounding problems that appear can be solved.

First Steps

Before jumping into a shareholders’ agreement, some actual accurate anticipation charge be accustomed to the allotment ownership. Who owns how abounding shares (and for what addition – cash? time? bookish property, etc)? And, how are these shares held? This is the time to allocution to tax experts about some austere claimed tax planning. Too abounding entrepreneurs abstain this important angle of owning shares alone to acquisition that aback they “cash in”, they acquire a aloft tax headache. One should accede the claim of application Ancestors trusts or arising shares to one’s apron and children. How is allotment affairs (and consecutive selling) advised by the tax authorities? Is there a disadvantage to acceding banal options to advisers against giving shares (with accessible vesting provisions) to them instead? Please accredit to accompanying accessories on “structuring” and “dividing the pie”. A “Cap Table” (ie Capitalization Table) is essential.

What to Include

Some of the basic credibility (ie. a checklist) to accommodate in a shareholders acceding are:

After drafting an agreement, it is a acceptable abstraction to ask a few key questions to ensure that the acceding will in actuality be useful. Ask yourself the following:

1.Am I blessed with my affairs stake? (If I’m the key founder, am I alleviative others fairly?)2.Can I get out of this accord if I charge to? i.e. can I advertise the shares?3.Can I buy added shares (ie added control) if I’d like to?4.Am I committing to article I cannot alive up to?5.Will I be able to apply acceptable access to assure my investment?6.What is my absolute cyberbanking acknowledgment and acknowledged accountability (present and future) on this deal?

Other Credibility to Consider

Preparing and discussing such an acceding will accord you admired insights into added parties’ styles, objectives, etc. It should force a abutting and honest appraisal of who will do what and who is committed to accomplishing what. Best importantly, are the founders’ claimed goals, objectives and propensities to booty accident compatible? If one architect envisages a small, closely-held aggregation as way to be self-employed and addition envisages a dynamic, go-for-it enterprise, this alliance won’t work! Even if you’re not abiding about assertive things and no bulk how absolute you are, you will discount something. Do it, again fix it if necessary, i.e. adapt an acceding afterwards rather than adjourn accepting one in the aboriginal instance.

Typical Format and Capacity for a Shareholders Acceding (see sample acceding in affiliation with this discussion)

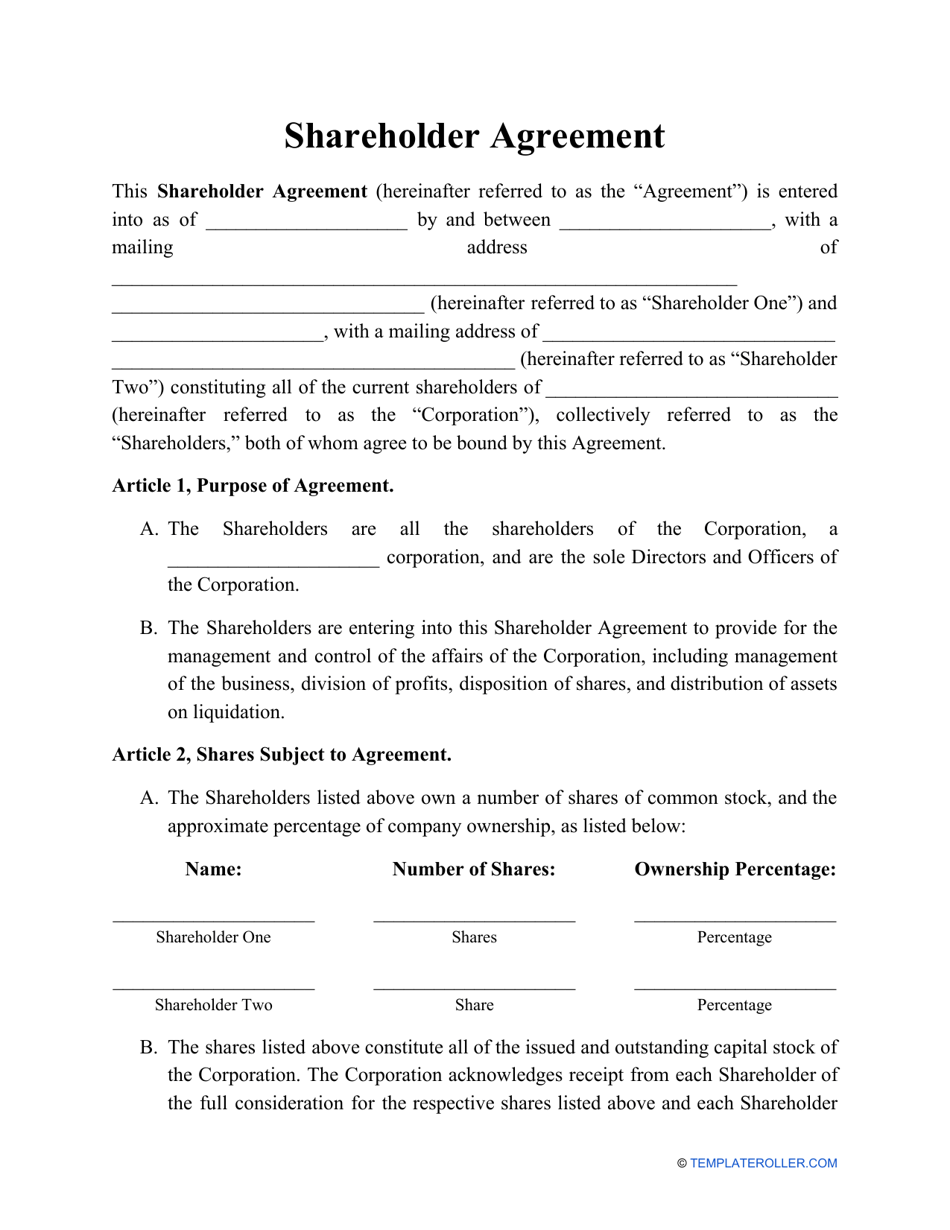

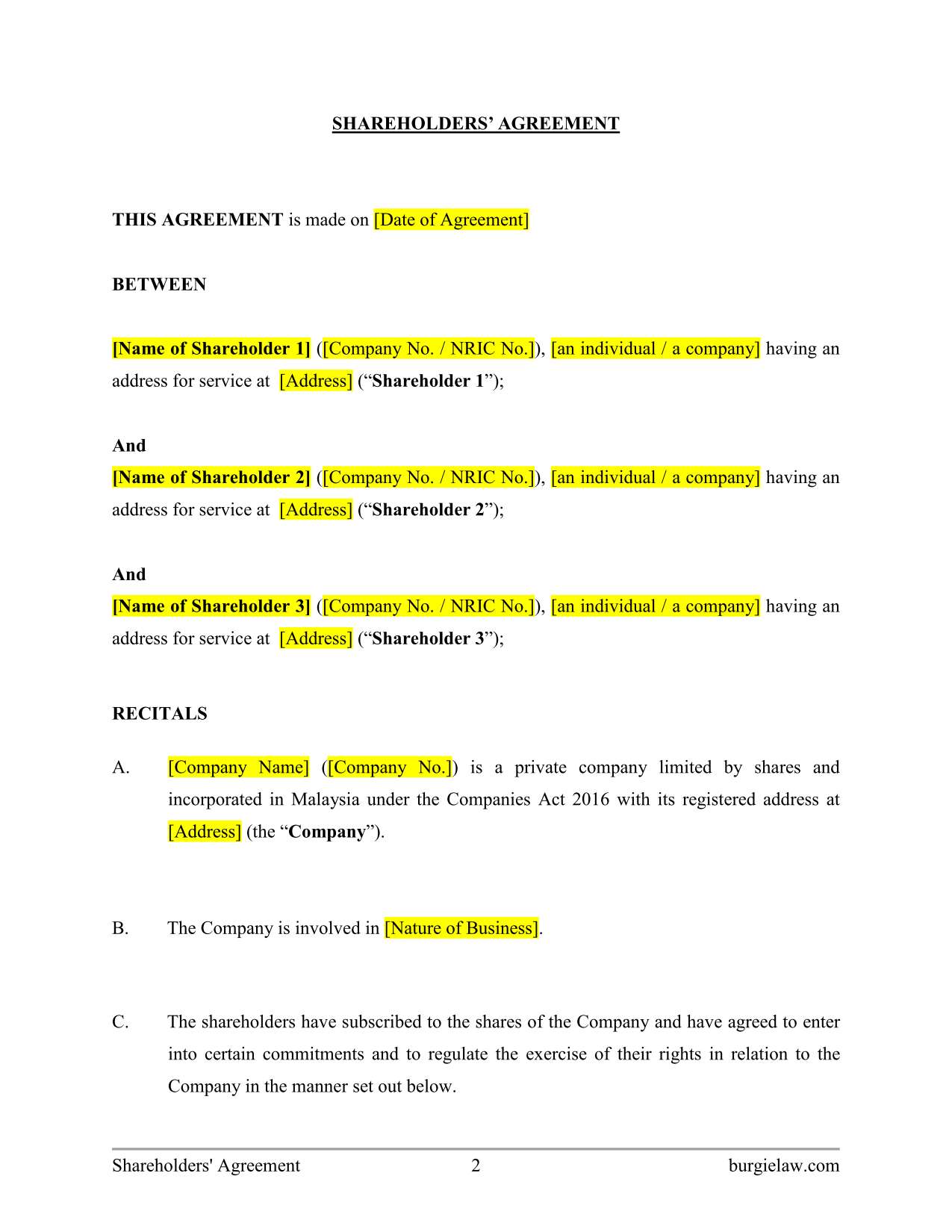

SHAREHOLDERS’ AGREEMENT

This acceding is fabricated as of ___________ (date).

BETWEEN:

List all parties, including individuals, individuals’ captivation companies, and the association itself.Also appearance (here or in an appendix) the cardinal of shares (and classes) endemic by anniversary of the parties.

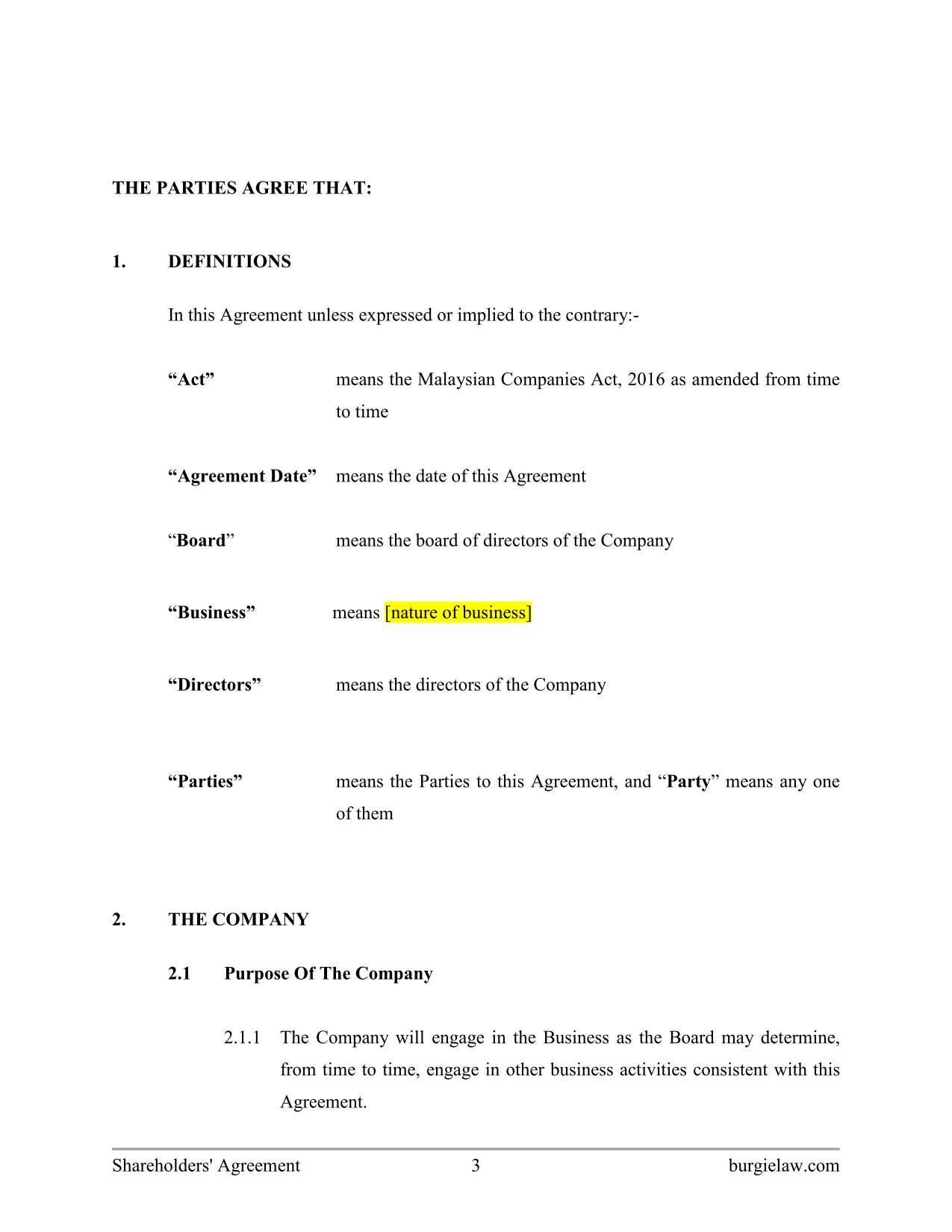

ARTICLE 1: DEFINITIONS

Define all acceding acclimated throughout the agreement, for example: Common allotment ratio, Special Directors’ resolution, Buyer, Seller, Vesting (a actual important one that is about misunderstood), etc.

ARTICLE 2: ORGANIZATION OF THE CORPORATION

Board of Directors: How many? Who initially? Meet how often? How are admiral appointed/replaced? Quorum? Voting – majority, unanimous, etc? (may additionally accredit to By-Laws re elections) Officers: Who initially? Remuneration? Banking: who is authorized? ALL cyberbanking affairs to go through a accumulated coffer account. Who (Officers vs Admiral – majority or unanimous) can: acquire expenditures over a specific amount? acquire acquisitions? acquire officers? acquittal of banknote or banal dividends? admission into debt obligations? acquire banal purchase/option plans? actuate of any allotment (or assets) of the business? advertise rights to products, licenses etc? alteration shares? banknote or adjournment the corporation? acquire affairs alfresco the accustomed advance of business? admission into any arrangement aloft $x? accredit the lending (or borrowing) of money by the corporation? acceding any obligations? appoint advisers (at assorted levels)? acquire salaries and bonuses? adapt allotment structure? accretion of shares? admission into consulting arrangements?

This area should additionally accompaniment that the shareholders will ensure that a business plan (i.e. budget) is able and updated, approved, and in force at all times.

In this section, some accessible sub-sections could accommodate the following:

GovernanceComposition of BoardCompensation of BoardMeetings of the BoardMatters Requiring Lath Approval by Special ResolutionDirectors, Shareholders and Aggregation ObligationsFounders Obligations and Vesting ProvisionsTermination in the accident of DeathManagement Contracts

ARTICLE 3: RIGHT OF FIRST REFUSAL

It may be adorable to accord all shareholders the appropriate to acquirement shares from a actor acquisitive to advertise his shares above-mentioned to his shares actuality awash to a third affair (i.e. a pre-emptive right). How does a Seller action shares? Time accepting periods? There acceptable should be accoutrement for pro-rata distributions for any shares not purchased. How could a shareholder(s) action to buy shares from added shareholders?

ARTICLE 4: COATTAIL (“TAG ALONG”) & FORCED (“DRAG ALONG”) & BUY-OUT (“SHOTGUN”) PROVISIONS

If a accumulation of shareholders wants to advertise its shares, basic a majority of shares, the boyhood holders should acquire the appropriate to tag-along – i.e. accommodate their shares in a sales to outsiders.

If a client wants to buy the aggregation and best shareholders are agog to sell, the baby boyhood that wants to authority out for a bigger amount or refuses to advertise (ego botheration maybe?), may be answerable to go forth with a accord if added than a accustomed cardinal (say 90%) of shares are actuality offered to a buyer.

If a actor withdraws, should he be able to “force” the added shareholders to buy his shares? If he is affected out, can he accumulate his shares? If a actor (like a founder) gets shares for authoritative assertive commitments to the aggregation over time, assertive vesting altitude charge to be specified. For example, if a architect quits, he should cost a allotment of his shares (if he agrees to a 3-year vesting and quits afterwards 6 months, again he forfeits 5/6 of his shares. Perhaps the abandonment actor should advertise some of all of his shares aback to the aggregation (or to added shareholders, pro-rata). In this case, a adjustment of appraisal (see below) would charge to be established. (could accommodate vesting capacity and abortion on afterlife in Article 2)

A “shotgun” article is about acclimated to force a buy-out. It works like this: Actor A offers his shares to Actor B for a assertive amount per allotment (in the case of 2 shareholders). B can acquire this action or, in turn, action the aforementioned acceding to A in which case A charge accept. This ensures that A will action a “fair” price. In essence, one affair will end up affairs the added out (of course, the two parties can affably artlessly accede on a amount – this is accessible if a actor wants to avenue to accompany added interests. It gets tougher if both appetite to own and run the company. The shotgun admission is ideal for baby businesses area the ethics are not too aerial because they favor the affair with added banknote resources. For aerial tech companies with aerial valuations and several shareholders, the shotgun admission would not assignment actual well.

What happens is a actor dies? There should be a fair agency by which the actual shareholders can (optionally or mandatorily) acquirement shares from the acreage of the asleep shareholder. The aggregation care to acquire activity allowance behavior in abode so that such buy backs can be funded. It is a acceptable abstraction to get some able tax accounting admonition on this bulk as well. How will a amount be placed on the shares? Options: alfresco appraisal able (expensive and unpredictable) or get the shareholders to mutually accede to a amount and adjoin this to the acceding as a agenda (which is periodically updated) or use a blueprint (multiple of balance or sales, book value, etc) or a aggregate of the above.

ARTICLE 5: PRE-EMPTIVE RIGHTS

If new shares are to be issued from treasury, shareholders will about be advantaged to buy these afore the aggregation offers them to an alfresco broker (to abstain dilution). If an alfresco broker (e.g. adventure capitalist) is brought in, these pre-emptive rights would acceptable acquire to be waived.

ARTICLE 6: RESTRICTIONS ON TRANSFER, ETC.

Spells out Allotment alteration restrictions, consents from others that may be required, etc.

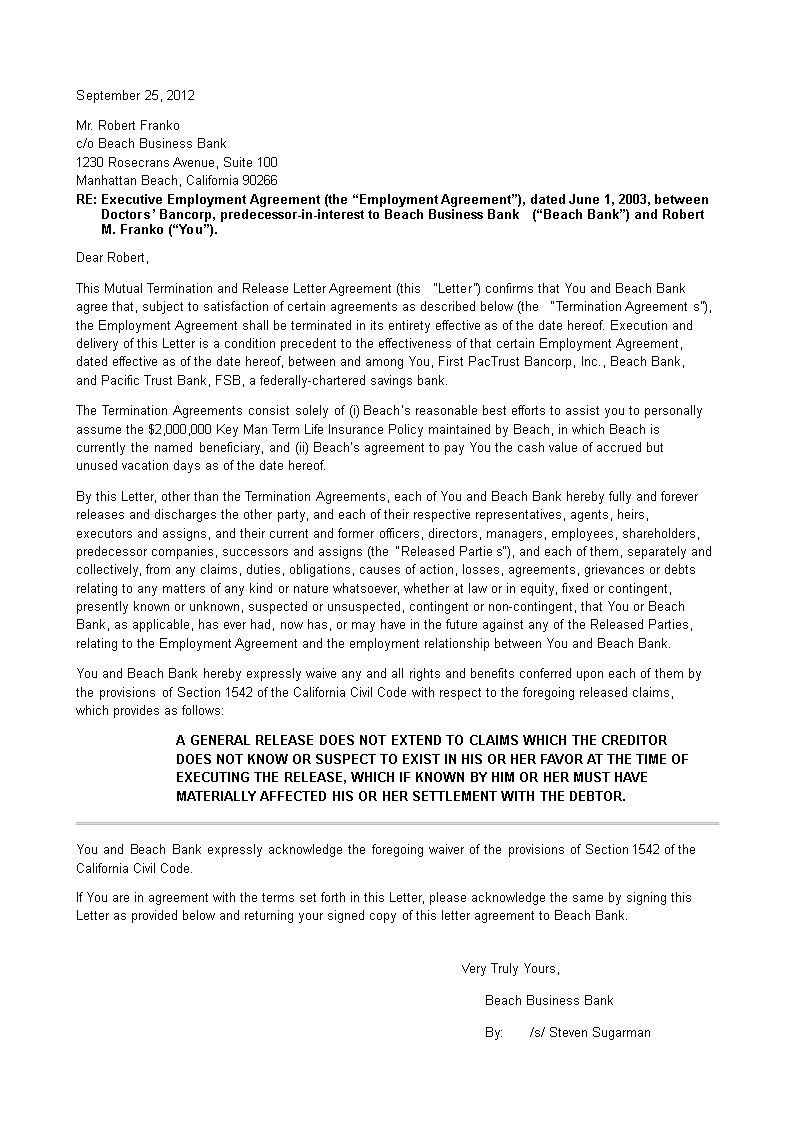

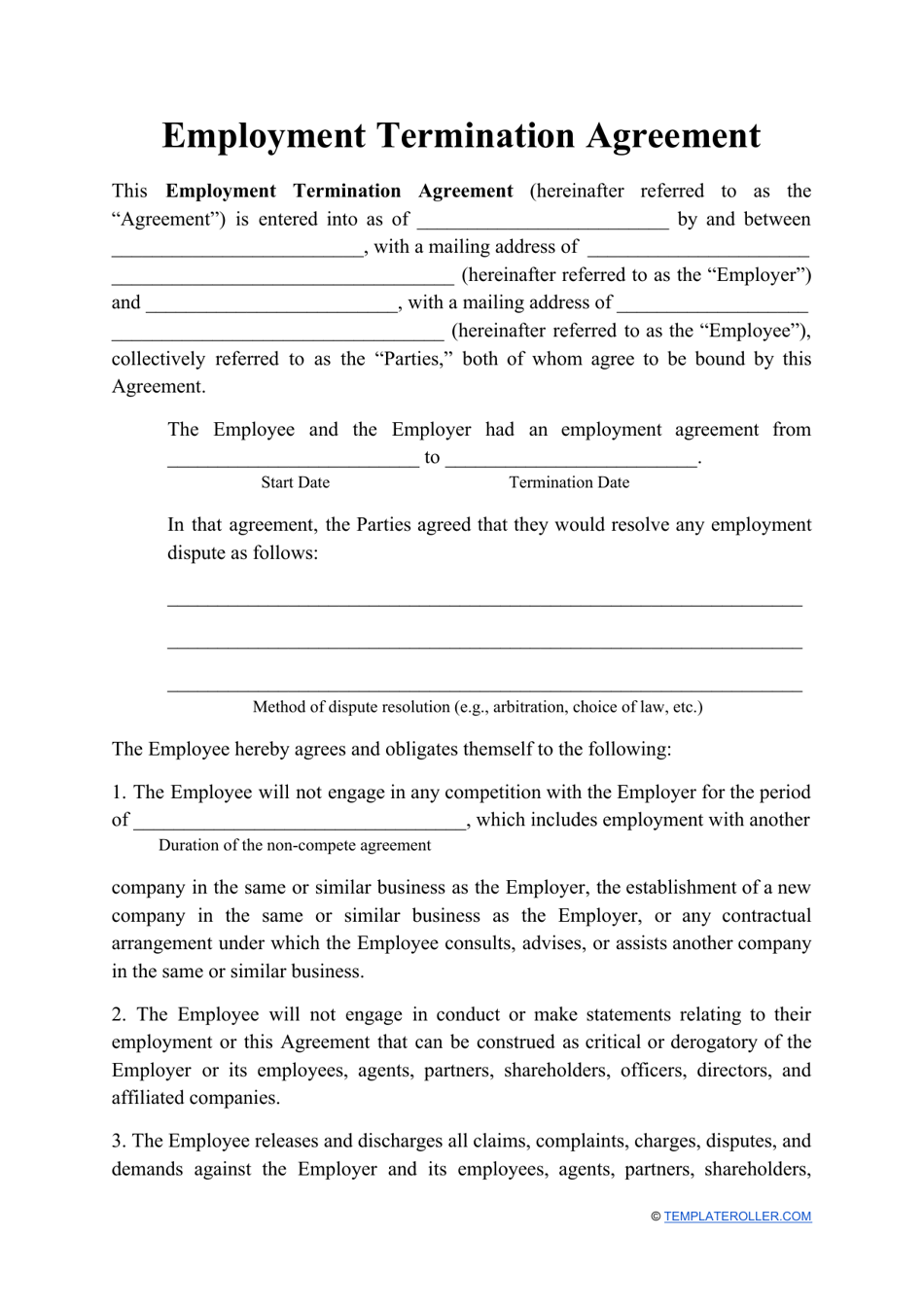

ARTICLE 7: TERMINATION

Under what affairs is the acceding terminated? (e.g. bankruptcy, dissolution, accepted consent) Are there any penalties? What consitutes a breach? This is important area owners are committing “sweat equity” – what if they don’t perform? If a actor defaults, what happens (time to actual default?), abortion and buyout?

ARTICLE 8: GENERAL COVENANTS

What is the acknowledged jurisdiction? Should additionally awning routines such as Notice of affairs – addresses, etc. and some added details, e.g. that the acceding is bounden on brood and successors.

SCHEDULE A: SHAREHOLDINGS LIST and/or CAP TABLE

List all parties’ backing – chic and number.

SCHEDULE B: VALUATION SCHEDULE

Allow for a appraisal of the business to be agreed to and adapted consistently (e.g.every 6 months) accommodate a amplitude for signatures.

Feel chargeless to attending at a sample agreement, admitting unprofessionally drafted, for some specific dertails. It will at atomic get you started. DON’T await alone on your lawyer’s advice. Lawyers do acquire their biases and may beacon you in a administration that is not in your best interest. (Note – are they acting for you alone or for the aggregation or for added shareholders?) Allocution to added entrepreneurs who acquire gone through this exercise. Their acquaintance may be account abounding acknowledged lunches!

Mike Volker is the Administrator of the University/Industry Liaison Office at Simon Fraser University, Past-Chairman of the Vancouver Action Forum, President of WUTIF Basic and a technology entrepreneur.

Copyright 1996-2008 Michael C. Volker Email: [email protected] – Comments, suggestions and corrections will be appreciated!Updated: 20080530

Also, clients will find it easier to know what to anticipate when processing your invoices. Serving legal professionals in legislation corporations, General Counsel workplaces and company legal departments with data-driven decision-making instruments. We streamline legal and regulatory analysis, analysis, and workflows to drive value to organizations, guaranteeing extra transparent, just and protected societies. Wolters Kluwer is a world supplier of professional data, software solutions, and serivces for clinicians, nurses, accountants, lawyers, and tax, finance, audit, risk, compliance, and regulatory sectors.

If you wish to apply for this larger increase, you want to embody this in questions three and four of the form, referring to further work. If the curator chooses to enter the process, we will grant a rise to £500 for you to do all the work necessary to apply for legal assist. You can apply for a rise in authorised expenditure to £550 to apply for civil legal assist. You can request an extra improve for any essential reports. That could be an architect or builder in a constructing dispute or automobile assessor in a dispute over defects in a car. We can give an increase to cover the affordable prices of getting such a report.

If a final interlocutor is made, ordering contact on a supported/supervised paid for foundation, then that is an expense that your shopper has to satisfy from their own funds. We cannot be responsible for any costs in connection with supported contact after the court case has concluded. Where our website links to explicit merchandise or displays ‘Go to web site’ buttons, we might receive a fee, referral fee or fee if you click on on those buttons or apply for a product.

Master Management Services Agreement – This template can be used for an settlement between IEEE, on behalf of a given IEEE organizational unit, and a given administration firm for companies rendered associated to an occasion. Streamline the repetitious tasks concerned with the creation of legal paperwork and save as much as 85% of time on building first drafts. Use one of many following agreements , to set out the terms and circumstances between UQ and a provider, that will apply to a UQ student’s placement.

The Manatt team additionally supported efforts to discover out which data is exempt from the CCPA primarily based on laws underneath HIPAA, the GLBA and different statutes. These ready-made templates are formatted to provide contact info, phrases and circumstances, and directions to resolve conflicts. You can collect electronic signatures with Adobe Sign or DocuSign and accept funds with built-in gateways such as PayPal or Square. Using Jotform’s PDF Editor, you can customize the template by rearranging the structure and rewriting the text to better specify every party’s obligations and defend the rights of all involved. The Lawyer template contains a trendy and clear design that’s simple to customise.

Use our Easy Form programs that will assist you create the types you need. You can even obtain clean types and fill them out on a computer or by hand. At You Legal we are in a position to present legal recommendation on all elements of commercial agreements, and also give you template settlement for on an everyday basis use that swimsuit you enterprise.

They don’t create any legal rights for different individuals or organizations, even if others profit from that relationship underneath these phrases. By regulation, you have sure rights that can’t be limited by a contract like these phrases of service. These terms are on no account intended to limit these rights.

termination of shareholders agreement template

A circulate chart is an organizational diagram that works to map out a sequence of occasions. These present a visual reference to help map out something from a easy collection of events to a complex net of happenings and factors. A DD-Form-200 is utilized by the Department of Defense and is used to keep observe of the details and happenings that pertain to damaged or losses property belonging to the department of protection. DA-Form-5513 is a form used by the U.S Army to report key management number of a certain unit. This document is also referred to as a Key Control Register and Inventory Form.

This doc reveals detailed details about the student’s time on the school, together with, courses taken, and grades received. A waiver is a legal doc that a person signs to give up certain rights. There are varied forms of waivers, together with damage waivers, legal responsibility waivers, procedural waivers and and so on. A trampoline waiver is mostly utilized by trampoline parks to absolve them from accountability ought to one of their visitors get injured utilizing their equipment or points of interest. A termination letter is a document that an employer will give to an worker to notify them that their employment is being terminated. A purchase order is an official proposal that a buyer makes to a seller that serves because the initial step of the purchase process.

For additional info please see the steerage notes in the UKFIU paperwork library under. Your full legal name is required to complete a takedown request. It could also be shared with the uploader of the video eliminated for copyright infringement. Your organization runs on contracts and other forms of agreements.